Digital Lending Platform 2024

In recent years, the financial services industry has undergone a significant transformation, driven by technological advancements and changing consumer expectations. Digital lending platforms have emerged as a key component of this evolution, reshaping the way individuals and businesses access credit. The Digital Lending Platform Market Share has grown rapidly as financial institutions and fintech companies leverage these platforms to enhance efficiency, improve customer experience, and expand their service offerings.

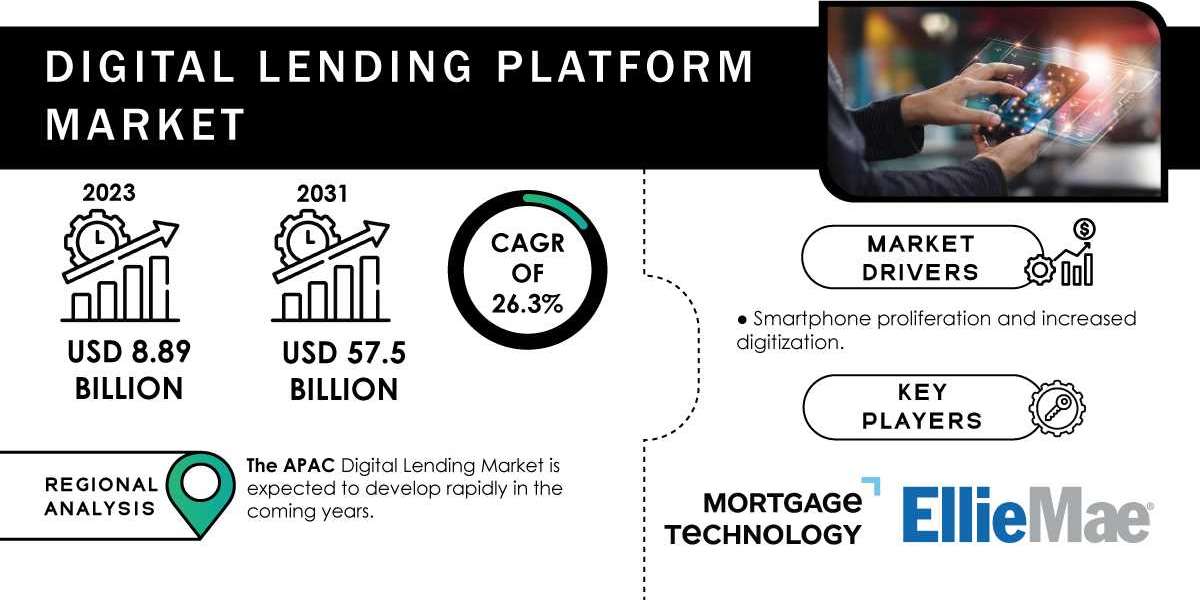

Digital lending platforms utilize technology to facilitate the borrowing process, offering a streamlined, user-friendly experience for borrowers. By automating various stages of the lending process—from application and approval to disbursement and repayment—these platforms significantly reduce the time and effort required for obtaining loans. The Digital Lending Platform Market size was valued at USD 8.89 billion in 2023 and is expected to reach USD 57.5 billion by 2031, growing at a CAGR of 26.3% over the forecast period of 2024-2031. This impressive growth underscores the increasing reliance on digital solutions in the lending sector, reflecting broader trends in consumer behavior and technological innovation.

The Evolution of Lending

Traditionally, the lending process was often cumbersome and time-consuming, involving extensive paperwork, lengthy approval times, and a reliance on in-person interactions. Borrowers frequently faced barriers such as credit history assessments and stringent requirements that could delay access to funds. Digital lending platforms have addressed these challenges by simplifying the process, enabling users to apply for loans online and receive decisions within minutes.

The introduction of alternative data sources and advanced algorithms has also transformed the credit assessment process. Instead of relying solely on credit scores, digital lending platforms analyze a wide range of data points, including social media activity, payment history, and transaction behaviors. This approach not only increases access to credit for underserved populations but also enhances risk assessment, allowing lenders to make more informed decisions.

Benefits of Digital Lending Platforms

One of the primary advantages of digital lending platforms is their ability to enhance the borrower experience. By providing a seamless online application process, borrowers can apply for loans from the comfort of their homes, avoiding the hassle of visiting physical branches. Additionally, the use of mobile applications allows borrowers to manage their loans, make payments, and track their financial health on the go, creating a more user-centric experience.

Speed is another critical benefit. Traditional lending processes can take days or even weeks to finalize, while digital lending platforms can often provide instant or same-day approvals. This rapid turnaround time is especially valuable in emergency situations, where quick access to funds is essential. By minimizing delays, digital lending platforms empower borrowers to take control of their financial situations more effectively.

Moreover, digital lending platforms often offer competitive interest rates and flexible repayment terms. Through automated processes and reduced overhead costs, lenders can pass on savings to borrowers, making loans more affordable. This increased accessibility to credit not only benefits individual borrowers but also stimulates economic growth by enabling small businesses and entrepreneurs to access the funding they need to thrive.

The Role of Data Analytics

Data analytics is at the heart of digital lending platforms, driving their efficiency and effectiveness. By leveraging machine learning and artificial intelligence, these platforms can analyze vast amounts of data to predict borrower behavior, assess risk, and tailor lending products to specific customer segments. For instance, predictive analytics can help lenders identify potential defaults before they occur, allowing for proactive risk management strategies.

Furthermore, the insights gained from data analytics enable lenders to develop personalized loan offerings. By understanding the needs and preferences of their customers, lenders can create targeted marketing campaigns and customize loan products that resonate with specific demographics. This data-driven approach not only enhances customer satisfaction but also improves conversion rates, as borrowers are more likely to engage with offerings that align with their financial goals.

Regulatory Considerations

As digital lending platforms gain prominence, regulatory scrutiny has increased. Governments and regulatory bodies are working to establish frameworks that ensure consumer protection and financial stability while promoting innovation. Compliance with regulations such as the Truth in Lending Act and the Fair Credit Reporting Act is essential for digital lenders to maintain trust and credibility.

Additionally, data privacy and security are paramount in the digital lending landscape. Given the sensitive nature of financial data, platforms must implement robust cybersecurity measures to protect against breaches and unauthorized access. Adhering to regulations such as the General Data Protection Regulation (GDPR) not only ensures compliance but also fosters consumer confidence in digital lending solutions.

The Impact of COVID-19

The COVID-19 pandemic has accelerated the adoption of digital lending platforms as individuals and businesses seek alternative financing options. With many traditional lending channels disrupted, borrowers turned to online solutions to meet their financial needs. This shift has highlighted the importance of digital transformation in the financial services sector, pushing institutions to invest in technology to remain competitive.

The pandemic also underscored the need for flexible lending solutions. Many borrowers faced unexpected challenges, such as job losses and reduced income, necessitating adjustments to repayment plans. Digital lending platforms that offer features like loan restructuring and deferment options have been able to better serve their customers during these uncertain times, fostering loyalty and trust.

Future Trends in Digital Lending

Looking ahead, several trends are expected to shape the digital lending landscape. One significant trend is the continued rise of embedded finance, where financial services are integrated into non-financial platforms. This shift allows businesses to offer seamless lending solutions at the point of sale, enhancing convenience for consumers and expanding access to credit.

Another emerging trend is the increasing use of blockchain technology in digital lending. Blockchain can enhance transparency, streamline processes, and reduce fraud risk by providing secure, immutable records of transactions. As more lenders explore the potential of blockchain, we may see a shift toward decentralized lending models that prioritize security and efficiency.

Finally, sustainability is becoming a critical consideration in the lending space. As consumers increasingly prioritize environmental and social responsibility, digital lending platforms may look to incorporate sustainability metrics into their lending criteria. This shift could lead to the rise of green loans and other environmentally focused financial products, aligning lending practices with broader societal goals.

Conclusion

Digital lending platforms are revolutionizing the way individuals and businesses access credit, providing a streamlined, efficient, and user-friendly experience. With the Digital Lending Platform Market witnessing remarkable growth, it is clear that these solutions are not only reshaping the lending landscape but also empowering borrowers with greater access to funds. As technology continues to evolve and consumer expectations change, the digital lending industry must adapt to remain competitive and responsive. By leveraging data analytics, prioritizing security, and embracing innovative trends, digital lending platforms are poised to play a pivotal role in the future of finance. As we move forward, the integration of technology and lending will undoubtedly lead to more inclusive and accessible financial solutions for all.

Contact Us:

Akash Anand – Head of Business Development Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Game-Based Learning Market Growth