The early production facility (EPF) sector is rapidly evolving, driven by advancements in technology, shifting market dynamics, and the ongoing need for efficient and flexible oil and gas production solutions. EPFs, which provide a temporary setup for early-stage production from newly discovered fields, offer numerous benefits including reduced time to market and cost efficiency. This article explores the current trends shaping the EPF market and provides forecasts for its future growth.

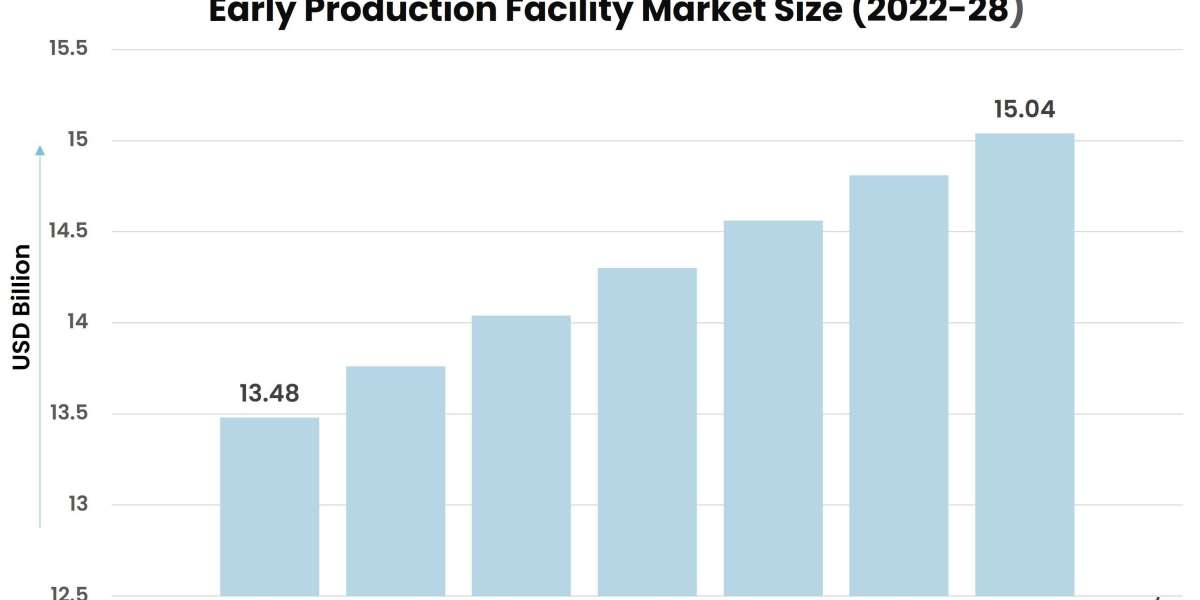

According to Stratview Research, the early production facility market was estimated at USD 13.48 billion in 2022 and is likely to grow at a CAGR of 1.79% during 2023-2028 to reach USD 15.04 billion in 2028.

Current Market Trends

- Increased Adoption of Modular Design

One of the most significant trends in the EPF sector is the increased adoption of modular design. Modular EPFs are pre-fabricated and assembled on-site, which significantly reduces construction time and costs. These facilities can be easily expanded or relocated, offering a flexible solution for operators. The modular approach also allows for standardized components, improving reliability and reducing maintenance requirements.

- Technological Advancements

Technological advancements are transforming the EPF sector. Innovations in automation, data analytics, and remote monitoring are enhancing the efficiency and safety of EPF operations. Automation reduces the need for on-site personnel, lowering operational costs and minimizing risks. Real-time data analytics enable operators to optimize production processes, improve resource management, and make informed decisions quickly. Additionally, advancements in material science and engineering are improving the durability and performance of EPFs.

- Focus on Cost Efficiency

With fluctuating oil prices and the need for cost-effective solutions, the focus on cost efficiency remains a critical driver in the EPF market. Operators are increasingly turning to EPFs as a cost-effective alternative to traditional production facilities. The lower capital expenditure and operational costs associated with EPFs make them particularly attractive for smaller or marginal fields where full-scale development may not be economically viable.

- Environmental Considerations

Environmental considerations are becoming more prominent in the oil and gas industry, and the EPF sector is no exception. Operators are looking for ways to minimize their environmental footprint, and EPFs offer several advantages in this regard. The temporary nature of EPFs means they can be decommissioned and removed with minimal environmental impact once production is complete. Furthermore, advancements in technology are enabling more efficient and cleaner production processes, reducing emissions and waste.

Market Forecasts

- Continued Growth

The early production facility market was estimated at USD 13.48 billion in 2022 and is likely to grow at a CAGR of 1.79% during 2023-2028 to reach USD 15.04 billion in 2028.

- Regional Expansion

In terms of regions, the market is segmented into North America, Europe, Asia Pacific, and the rest of the world. Among these regions, North America is expected to be the dominant region throughout the forecast period. Over the years, the US, in particular, has taken up several initiatives and measures in order to explore the new oilfield reserves in the regions such as the South China Sea, Persian Gulf, North Sea, and the Gulf of Mexico, so as to cater to the growing demand.

- Integration of Renewable Energy

As the energy sector moves towards sustainability, there is potential for the integration of renewable energy sources with EPFs. Hybrid EPFs that incorporate solar or wind power for operational energy needs can reduce the reliance on traditional fossil fuels and lower the environmental impact. This trend aligns with the broader industry shift towards greener practices and offers a competitive advantage for operators adopting sustainable solutions.

Conclusion

The early production facility sector is poised for continued growth and innovation. The adoption of modular designs, technological advancements, focus on cost efficiency, and increasing environmental considerations are key trends shaping the market. With significant growth opportunities in emerging regions and the potential for integrating renewable energy, the future of the EPF market looks promising. Operators and stakeholders in the oil and gas industry must stay attuned to these trends to capitalize on the opportunities and navigate the challenges ahead.