Fraud Detection and Prevention 2024

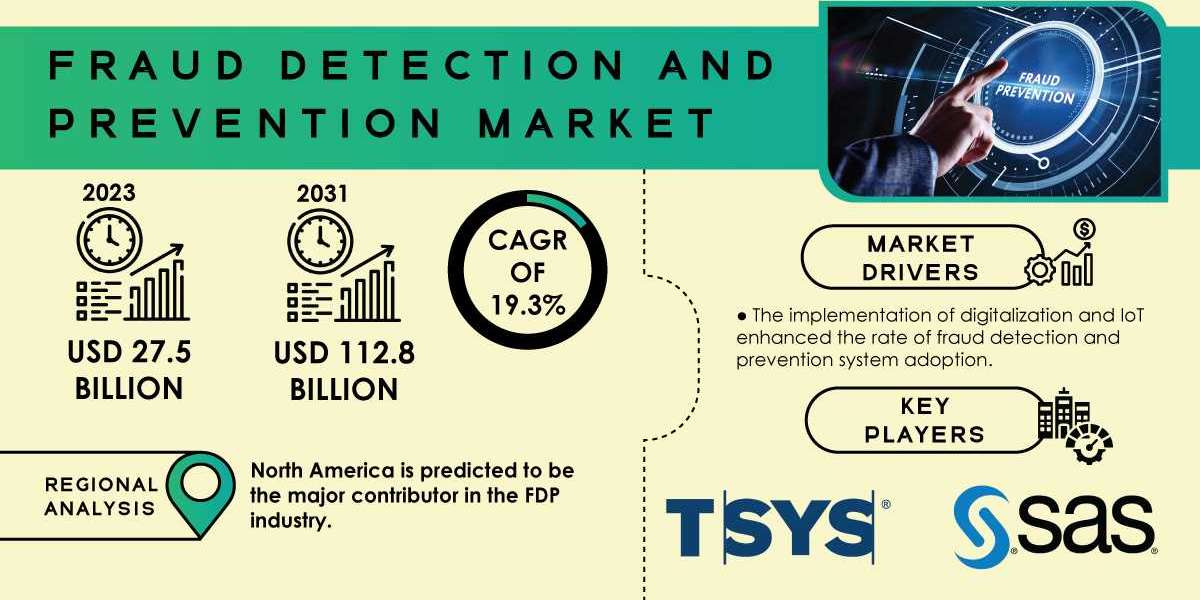

In an era characterized by rapid technological advancements and the widespread adoption of digital transactions, the importance of robust fraud detection and prevention strategies has never been more critical. Businesses across various sectors face increasing threats from fraudulent activities, ranging from payment fraud to identity theft and beyond. The Fraud Detection and Prevention Market Share underscores this growing concern, as the Fraud Detection and Prevention Market was valued at USD 25.2 billion in 2023 and is expected to reach USD 112.8 billion by 2032, growing at a CAGR of 18.1% from 2024 to 2032. This article delves into the multifaceted world of fraud detection and prevention, exploring its significance, methods, technologies, and the evolving landscape of threats.

Fraud, in its many forms, poses a significant risk to organizations, potentially leading to substantial financial losses, reputational damage, and legal ramifications. As businesses increasingly transition to online platforms, the frequency and sophistication of fraud attempts have surged. Traditional methods of fraud detection, which often relied on manual reviews and static rules, are no longer sufficient to combat the dynamic and evolving nature of fraud. Consequently, organizations are turning to advanced technologies and methodologies to enhance their fraud detection and prevention capabilities.

The Importance of Fraud Detection and Prevention

The ramifications of fraud can be devastating for businesses. Beyond the immediate financial losses, fraud can erode customer trust, damage brand reputation, and lead to regulatory scrutiny. In a digital environment where customers are increasingly cautious about sharing personal information and engaging in online transactions, the stakes are high. A successful fraud incident can lead to customer attrition, increased operational costs due to investigations and legal actions, and a decline in market competitiveness.

Effective fraud detection and prevention strategies not only protect organizations from financial losses but also bolster customer confidence. By demonstrating a commitment to security and proactive risk management, businesses can enhance their reputation and attract more customers. Furthermore, with regulatory bodies imposing stringent compliance requirements, organizations that invest in robust fraud prevention measures can mitigate the risk of legal penalties.

Methods of Fraud Detection

Fraud detection methods have evolved significantly over the years, thanks to advancements in technology and data analytics. Organizations now employ a variety of techniques to identify and mitigate fraudulent activities.

One of the most widely used methods is rule-based detection. This approach involves defining a set of rules or parameters that trigger alerts when specific conditions are met. For example, if a transaction exceeds a certain amount or occurs from an unusual geographic location, the system can flag it for further review. While rule-based systems are effective for identifying known fraud patterns, they may struggle to detect new or sophisticated fraud schemes.

To address the limitations of rule-based systems, many organizations are turning to machine learning and artificial intelligence (AI). These technologies enable fraud detection systems to analyze vast amounts of historical data and identify patterns that may indicate fraudulent behavior. By learning from past incidents, machine learning algorithms can adapt and improve their detection capabilities over time, making them more effective in identifying emerging threats.

Behavioral analytics is another key component of modern fraud detection. This method focuses on understanding customer behavior and identifying anomalies that could indicate fraud. For instance, if a user suddenly attempts to log in from a different device or location, the system may flag this as suspicious activity. By monitoring user behavior and establishing baseline patterns, organizations can detect deviations that warrant further investigation.

Technologies Driving Fraud Prevention

The rapid advancement of technology has paved the way for innovative fraud prevention solutions. Some of the most impactful technologies include:

Biometrics: Biometric authentication methods, such as fingerprint recognition, facial recognition, and iris scans, provide an additional layer of security. By using unique physical characteristics to verify identity, businesses can significantly reduce the risk of unauthorized access and identity theft.

Data Encryption: Encrypting sensitive data, both in transit and at rest, is crucial for protecting customer information from breaches. Encryption ensures that even if data is intercepted, it remains unreadable without the appropriate decryption key.

Real-time Monitoring: Advanced fraud detection systems leverage real-time monitoring capabilities to assess transactions as they occur. By analyzing data in real time, organizations can identify and respond to potential fraud attempts more quickly, minimizing potential losses.

Threat Intelligence: Threat intelligence platforms aggregate data on emerging threats, vulnerabilities, and attack patterns from various sources. By staying informed about the latest fraud trends and tactics, organizations can enhance their preventive measures and adapt their strategies accordingly.

Challenges in Fraud Detection and Prevention

Despite the advancements in fraud detection and prevention technologies, organizations still face several challenges. One significant hurdle is the ever-evolving nature of fraud schemes. As businesses implement new technologies and security measures, fraudsters continually adapt their tactics to exploit vulnerabilities. This cat-and-mouse game necessitates ongoing investment in advanced detection methods and employee training.

Another challenge is the balance between security and user experience. Stricter fraud prevention measures can inadvertently lead to friction in the customer experience. For example, if a legitimate transaction is flagged as suspicious, it can result in delays, customer frustration, and abandoned purchases. Organizations must strike a delicate balance between robust security measures and providing a seamless experience for their customers.

Data privacy regulations also pose challenges for fraud detection efforts. Organizations must navigate a complex landscape of legal requirements while implementing fraud prevention measures. Striking the right balance between data protection and effective fraud detection is crucial, and organizations must ensure that their strategies comply with applicable regulations.

Future Trends in Fraud Detection and Prevention

Looking ahead, several trends are poised to shape the future of fraud detection and prevention. One notable trend is the increasing integration of AI and machine learning into fraud prevention systems. As these technologies become more sophisticated, they will enhance the ability of organizations to detect and prevent fraud in real-time, ultimately reducing losses and improving customer experiences.

The adoption of blockchain technology is another emerging trend. Blockchain’s decentralized and immutable nature makes it inherently secure, making it difficult for fraudsters to manipulate data. Organizations are exploring the use of blockchain to enhance transparency and traceability in transactions, particularly in sectors such as finance and supply chain management.

Furthermore, as cyber threats become more complex, collaboration among organizations is becoming essential. Information sharing and collaboration on threat intelligence can help organizations stay ahead of fraudsters and enhance their collective defenses. Industry alliances and partnerships can play a critical role in fostering this collaborative approach.

Conclusion

Fraud detection and prevention are paramount for businesses operating in today’s digital landscape. With the increasing frequency and sophistication of fraud attempts, organizations must invest in advanced technologies and methodologies to protect themselves and their customers. By leveraging machine learning, behavioral analytics, and innovative security measures, businesses can enhance their fraud detection capabilities and safeguard their operations.

As the fraud landscape continues to evolve, staying informed about emerging trends and adapting strategies accordingly will be critical for organizations aiming to combat fraud effectively. Ultimately, a proactive and comprehensive approach to fraud detection and prevention will not only mitigate risks but also enhance customer trust and loyalty in an increasingly competitive market.

Contact Us:

Akash Anand – Head of Business Development Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Network Transformation Market Growth