IMARC Group has recently released a new research study titled “Chandelier Market Report by Product (Traditional, Transitional, Modern), Application (Residential, Commercial), Distribution Channel (Offline, Online), and Region 2025-2033”. The study provides a detailed analysis of the industry, including the global chandelier market trends, share, size, growth and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

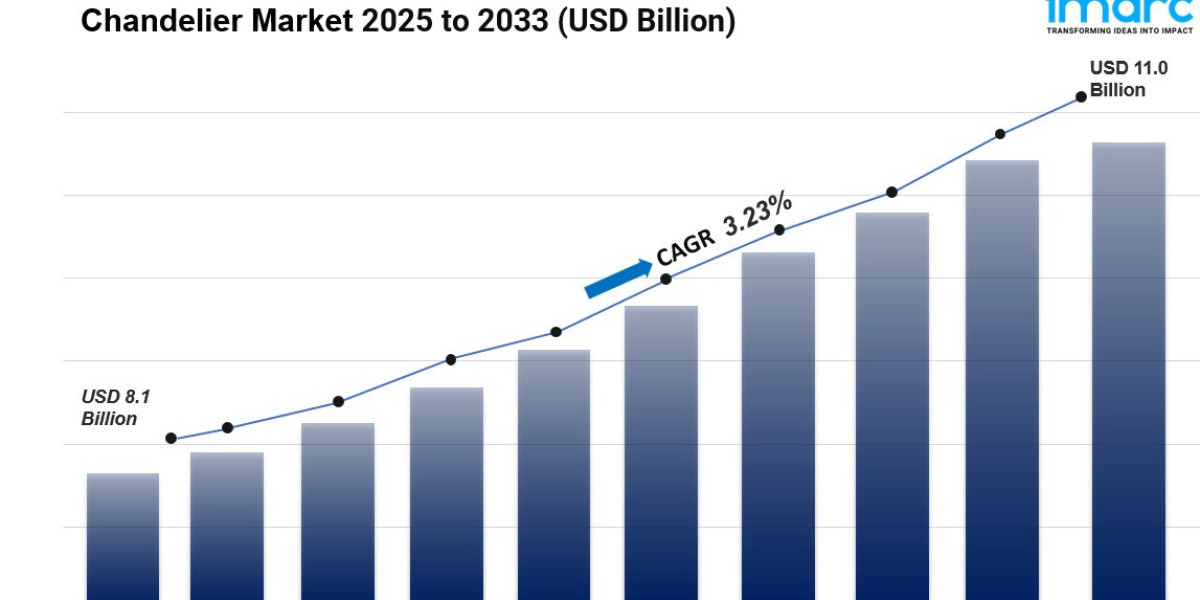

The global chandelier market size reached USD 8.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.23% during 2025-2033. The rising demand for aesthetically appealing lighting fixtures in residential and commercial settings, the growing popularity of interior design and creating ambiance among the masses, and technological advancements in lighting systems, such as the incorporation of energy-efficient LED lights, and integration of smart home technology are some of the factors propelling the market.

Global Chandelier Market Trends:

The ongoing shift towards urbanization, leading to the demand for chandeliers that are suited for smaller spaces, is positively impacting the market growth. Besides this, the rising trend in do-it-yourself (DIY) home improvement projects, spurring the demand for customizable and easy-to-install chandeliers, is creating a positive outlook for the market. In addition to this, the emergence of e-commerce platforms that made chandeliers more accessible to a wider audience while offering a vast selection at various price points is providing a considerable boost to the market growth.

Factors Affecting the Growth of the Chandelier Industry:

Growing Consumer Expenditure Capacity:

The global rise in disposable income, particularly in developing economies, has transformed consumer purchasing behavior, enabling people to invest in premium home décor items like chandeliers. In regions where rapid economic development has brought about higher income levels, there is a growing trend among consumers to spend on items that elevate the visual appeal of their living spaces. Chandeliers are increasingly viewed not only as functional lighting but also as symbols of affluence and aesthetic sophistication, representing a lifestyle upgrade. With urbanization on the rise, more people are moving to cities and adopting urban lifestyles that place a higher value on home aesthetics and luxury. Additionally, urban centers are expanding, with new residential and commercial spaces being developed at an unprecedented rate.

Expansion of the Hospitality and Real Estate Sectors:

According to the latest market forecast, the hospitality and real estate industries have become key contributors to the growth of chandelier market size, driven by a need for distinctive, luxurious interior design elements. In hospitality, chandeliers create a striking first impression, enhancing ambiance and elevating the guest experience in hotels, resorts, and upscale dining establishments. High-end hotels and resorts especially use custom-designed chandeliers in lobbies, banquet halls, and suites, as these lighting fixtures add grandeur and sophistication, which are essential to their brand image. Similarly, the luxury real estate sector, including high-end residential apartments, villas, and premium office spaces, relies on unique lighting solutions to attract affluent buyers and renters. Chandeliers are often an integral part of staging properties to showcase opulence and exclusivity.

Trends in Home Renovation:

Home renovation and remodeling trends have gained momentum in recent years, which, in turn, is boosting the market share. Chandeliers are now frequently chosen as centerpiece lighting fixtures, appreciated not only for their functionality but for the ambiance and elegance they bring to various rooms, particularly living rooms, dining areas, and entryways. As interior design trends shift toward open floor plans and minimalist aesthetics, chandeliers serve as statement pieces that can tie a room together, blending function with visual appeal. Social media and design inspiration platforms have popularized the trend of incorporating chandeliers as a key element in home makeovers, driving consumer interest and demand. Additionally, the home renovation market has benefited from government incentives in many countries, which encourage homeowners to invest in energy-efficient home upgrades.

Request to Get the Sample Report: https://www.imarcgroup.com/chandelier-market/requestsample

Chandelier Market Report Segmentation:

Breakup By Product:

- Traditional

- Transitional

- Modern

Transitional account for the majority of shares as they cater to broad consumer preferences, making them highly popular across diverse interior design trends.

Breakup By Application:

- Residential

- Commercial

Commercial dominates the market as it heavily invests in chandeliers to create an upscale ambiance and attract clientele.

Breakup By Distribution Channel:

- Offline

- Online

Offline holds the majority of shares because many consumers prefer purchasing chandeliers offline to assess the product’s scale, quality, and aesthetic impact.

Breakup By Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

North America holds the leading position owing to high disposable incomes, a thriving luxury real estate market, and strong demand for home décor products.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=8737&flag=C

Top Chandelier Market Leaders:

The chandelier market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- American Brass & Crystal

- Dolan Designs

- Elegant Lighting

- Hubbell Incorporated

- King's Chandelier Company

- Kurt Faustig K

- Maxim Lighting International

- Myran Allan Luxury Lighting

- Signify Holding

- Vanguard Lighting Co. Ltd.

- Zhongshan Fusida Lighting Co. Ltd.

Key Highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- Market Trends

- Market Drivers and Success Factors

- Impact of COVID-19

- Value Chain Analysis

- Comprehensive mapping of the competitive landscape

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145