"Business Process as a Service (BPaaS) Market Size And Forecast by 2031

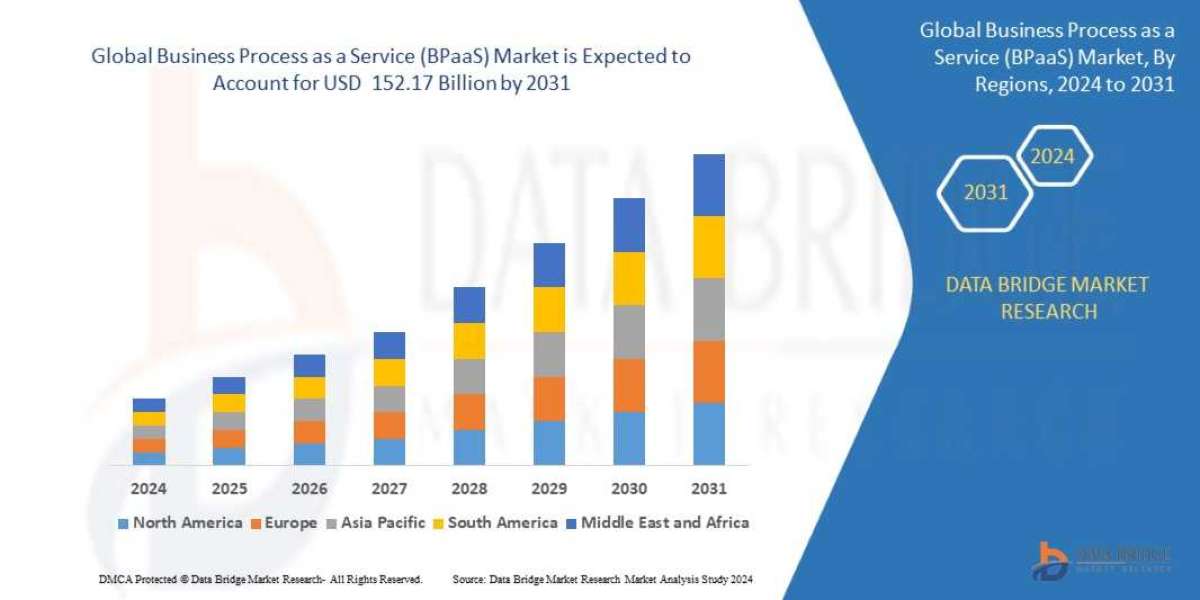

Data Bridge Market Research analyses that the Global Business Process as a Service (BPaaS) Market which was USD 58.68 Billion in 2023 is expected to reach USD 152.17 Billion by 2031 and is expected to undergo a CAGR of 12.70% during the forecast period of 2023 to 2031

Business Process as a Service (BPaaS) Market research report provides a comprehensive analysis of the market. The report aims to provide insights into Business Process as a Service (BPaaS) Market trends, growth opportunities, key drivers and challenges, competitive landscape, and other crucial factors that may impact the market in the forecast period (2024-2031).

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-business-process-as-a-service-bpaas-market

Which are the top companies operating in the Business Process as a Service (BPaaS) Market?

The study report on the Global Business Process as a Service (BPaaS) Market offers a comprehensive analysis of the industry, highlighting key trends, market dynamics, and competitive landscape. It profiles prominent organizations operating in the market, examining their successful strategies and market share contributions. This Business Process as a Service (BPaaS) Market report provides the information of the Top 10 Companies in Business Process as a Service (BPaaS) Market in the market their business strategy, financial situation etc.

**Segments**

- **By Component:** The BPaaS market can be segmented by component into platform and services. The platform segment includes application, process, and integration platform-as-a-service offerings that enable organizations to automate and streamline their business processes. On the other hand, the services segment includes consulting, implementation, and support services provided by BPaaS vendors to help clients optimize their operations and achieve business goals.

- **By Deployment Model:** Based on deployment model, the BPaaS market can be categorized into public cloud, private cloud, and hybrid cloud. Public cloud deployment offers scalability and cost-efficiency, ideal for organizations looking for on-demand services. Private cloud deployment provides enhanced security and control over data, making it suitable for enterprises with strict compliance requirements. Hybrid cloud deployment combines the benefits of both public and private clouds, allowing organizations to leverage the flexibility of public cloud while ensuring sensitive data remains secure in a private cloud environment.

- **By Organization Size:** The BPaaS market can also be segmented by organization size into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly adopting BPaaS solutions to streamline their operations, reduce costs, and improve efficiency. Large enterprises, on the other hand, are leveraging BPaaS platforms to manage complex business processes at scale and drive digital transformation initiatives.

**Market Players**

- **IBM Corporation:** IBM offers a comprehensive suite of BPaaS solutions, including business process management and automation services, to help organizations improve operational efficiency and agility.

- **SAP SE:** SAP provides BPaaS offerings that combine industry-specific best practices with advanced technology to enable organizations to optimize their business processes and drive innovation.

- **Oracle Corporation:** Oracle's BPaaS solutions encompass a wide range of cloud-based services, such as finance and human resources management, to help businesses streamline operations and enhance decision-making.

- **Accenture Plc:** Accenture delivers end-to-end BPaaS services, from strategy and consulting to implementation and managed services, to assist clients in achieving digital transformationIBM Corporation is a key player in the BPaaS market, offering a robust suite of solutions aimed at improving operational efficiency and agility for organizations. With a focus on business process management and automation services, IBM enables clients to streamline their operations and enhance their competitiveness in the digital age. By leveraging IBM's BPaaS offerings, businesses can optimize their processes, reduce costs, and drive innovation to stay ahead in today's rapidly evolving business landscape. The company's expertise in delivering end-to-end solutions makes it a preferred choice for organizations looking to transform their operations and achieve tangible business outcomes.

SAP SE is another prominent player in the BPaaS market, known for its industry-specific best practices and advanced technology solutions. SAP's BPaaS offerings are designed to help organizations optimize their business processes and drive innovation by combining cutting-edge technology with deep industry expertise. Through its comprehensive suite of solutions, SAP enables clients to achieve operational excellence, enhance decision-making capabilities, and create new opportunities for growth and expansion. With a focus on industry-specific solutions, SAP caters to a wide range of sectors, including manufacturing, retail, healthcare, and finance, positioning itself as a leading provider of BPaaS services globally.

Oracle Corporation is a key player in the BPaaS market, offering a diverse range of cloud-based services tailored to streamline operations and enhance decision-making capabilities for businesses. With a focus on finance and human resources management, Oracle's BPaaS solutions empower organizations to drive efficiency, reduce costs, and improve overall performance. By leveraging Oracle's expertise in cloud technology and data management, businesses can achieve greater agility, flexibility, and scalability in their operations, enabling them to adapt to changing market dynamics and drive sustainable growth over time. Oracle's commitment to innovation and continuous improvement makes it a trusted partner for organizations seeking to optimize their business processes and enhance their competitive advantage.

Accenture Plc stands out in the BPaaS market for its end-to-end services that span strategy, consulting, implementation, and managed services to assist clients in achieving digital transformation and**Market Players:**

- IBM Corporation (U.S.)

- Capgemini (France)

- Cognizant (U.S.)

- Oracle (U.S.)

- Wipro Limited (India)

- Accenture (Ireland)

- Tata Consultancy Services Limited (India)

- HCL Technologies Limited (India)

- NTT DATA, Inc. (U.S.)

- DXC Technology Company (U.S.)

- Open Text Corporation (Canada)

- FUJITSU (Japan)

- Genpact (U.S.)

- ADP, Inc. (U.S.)

- Alight (U.S.)

- UKG Inc. (U.S.)

- WNS (Holdings) Ltd. (India)

- Conduent, Inc. (U.S.)

- Expertel S.A ""proceedit"" (Luxembourg)

- TIBCO Software Inc. (U.S.)

- Entercoms (U.S.)

- Avaloq (Switzerland)

- Scheer PAS Deutschland GmbH (Germany)

- Ceridian HCM, Inc. (U.S.)

**Market Analysis:**

The BPaaS market is witnessing significant growth and transformation driven by the increasing demand for streamlined business processes, operational efficiency, and digital transformation initiatives across industries. Key market players such as IBM Corporation, SAP SE, Oracle Corporation, and Accenture Plc are at the forefront of providing innovative BPaaS solutions that cater to the diverse needs of organizations worldwide. These market leaders offer a wide range

Explore Further Details about This Research Business Process as a Service (BPaaS) Market Report https://www.databridgemarketresearch.com/reports/global-business-process-as-a-service-bpaas-market

Regional Analysis For Business Process as a Service (BPaaS) Market

North America (the United States, Canada, and Mexico)

Europe (Germany, France, UK, Russia, and Italy)

Asia-Pacific (China, Japan, Korea, India, and Southeast Asia)

South America (Brazil, Argentina, Colombia, etc.)

The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa)

Why B2B Companies Worldwide Rely on us to Grow and Sustain Revenues:

- Get a clear understanding of the Business Process as a Service (BPaaS) Market, how it operates, and the various stages of the value chain.

- Understand the current market situation and future growth potential of the Business Process as a Service (BPaaS) Market throughout the forecast period.

- Strategize marketing, market-entry, market expansion, and other business plans by understanding factors influencing growth in the market and purchase decisions of buyers.

- Understand your competitors’ business structures, strategies, and prospects, and respond accordingly.

- Make more informed business decisions with the help of insightful primary and secondary research sources.

This report provides Global Business Process as a Service (BPaaS) Market :

- An in-depth overview of the global market for

- Business Process as a Service (BPaaS) Market Assessment of the global industry trends, historical data from 2015, projections for the coming years, and anticipation of compound annual growth rates (CAGRs) by the end of the forecast period.

- Discoveries of new market prospects and targeted marketing methodologies for Global Business Process as a Service (BPaaS) Market

- Discussion of RD, and the demand for new products launches and applications.

- Wide-ranging company profiles of leading participants in the industry.

- The composition of the market, in terms of dynamic molecule types and targets, underlining the major industry resources and players.

- The growth in patient epidemiology and market revenue for the market globally and across the key players and Business Process as a Service (BPaaS) Market segments.

- Study the market in terms of generic and premium product revenue.

- Determine commercial opportunities in the market sales scenario by analyzing trends in authorizing and co-development deals.

Understanding market trends and industry insights at a regional level is essential for effective decision-making. Our reports are available in multiple regional languages to cater to diverse audiences. These localized reports provide in-depth analyses tailored to specific regions, ensuring businesses and stakeholders can access accurate and relevant information. By offering insights in local languages, we aim to bridge communication gaps and empower regional markets with the knowledge they need to grow and thrive. Explore our reports in your preferred language for a more personalized understanding of industry dynamics.

Japanese : https://www.databridgemarketresearch.com/jp/reports/global-business-process-as-a-service-bpaas-market

Chinese : https://www.databridgemarketresearch.com/zh/reports/global-business-process-as-a-service-bpaas-market

Arabic : https://www.databridgemarketresearch.com/ar/reports/global-business-process-as-a-service-bpaas-market

Portuguese : https://www.databridgemarketresearch.com/pt/reports/global-business-process-as-a-service-bpaas-market

German : https://www.databridgemarketresearch.com/de/reports/global-business-process-as-a-service-bpaas-market

French : https://www.databridgemarketresearch.com/fr/reports/global-business-process-as-a-service-bpaas-market

Spanish : https://www.databridgemarketresearch.com/es/reports/global-business-process-as-a-service-bpaas-market

Korean : https://www.databridgemarketresearch.com/ko/reports/global-business-process-as-a-service-bpaas-market

Russian : https://www.databridgemarketresearch.com/ru/reports/global-business-process-as-a-service-bpaas-market

Data Bridge Market Research:

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 1057