"North America Flow Cytometry Market Size, Share, and Trends Analysis Report—Industry Overview and Forecast to 2032

The U.S. Flow Cytometry Market is witnessing significant growth, driven by evolving consumer demands, technological advancements, and expanding global trade. Leading market research companies indicate that the North America Cell Sorting Market is expected to experience steady expansion in the coming years, fueled by increased investments and innovation. Businesses are increasingly relying on market insights to stay competitive in the Flow Cytometry and Cell Analysis Market in North America, making data-driven decisions essential. With a growing focus on sustainability and efficiency, the North American Cytometry Solutions Market is adapting to new trends that reshape industry dynamics. Comprehensive reports from top research firms highlight the critical role of analytics and strategic planning in the U.S. Flow Cytometry Equipment Market.

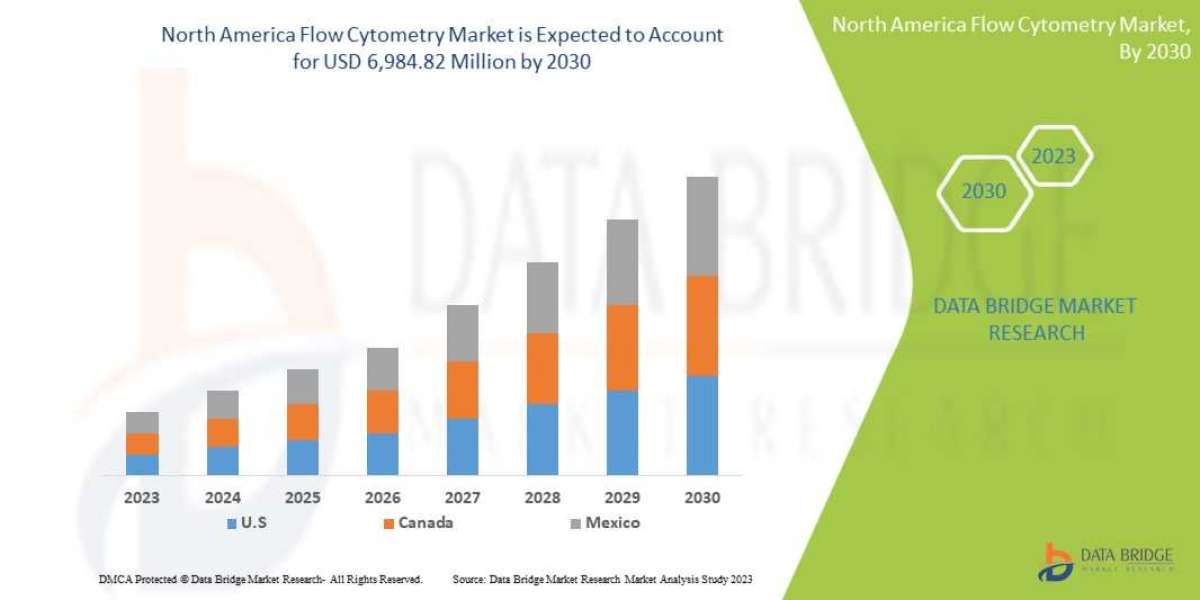

The North America Flow Cytometry Market is poised for significant growth, with a market outlook highlighting substantial growth potential driven by emerging opportunities in key sectors. This report provides strategic insights, demand dynamics, and revenue projections, offering a comprehensive view of the future landscape, technology disruptions, and adoption trends shaping the industry’s ecosystem evaluation. According to Data Bridge Market Research North America flow cytometry market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 12.6% in the forecast period of 2023 to 2030 and is expected to reach USD 6,984.82 Million by 2030 from USD 2,725.01 Million in 2022.

With increasing globalization and digital disruption, the North America Fluorescence Flow Cytometry Market is expanding across multiple industries, including [industry name]. Market research data indicates that businesses in the Cytometric Analysis Market in North America are adopting sustainable practices and improving supply chain management to optimize operations. Companies operating in the North American Cellular Analysis Market are investing heavily in RD, strategic partnerships, and innovative solutions to cater to changing market needs. As competition intensifies, firms in the Flow Cytometry Services Market in the U.S. rely on expert insights and market analysis to identify growth opportunities. The North America Blood Cell Analysis Market continues to evolve, shaping new business strategies and industry trends worldwide.

Our comprehensive North America Flow Cytometry Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://www.databridgemarketresearch.com/reports/north-america-flow-cytometry-market

The North America Flow Cytometry Market is expected to showcase significant growth in the coming years, driven by various factors such as increasing prevalence of chronic diseases, technological advancements in flow cytometry systems, and growing adoption of flow cytometry techniques in drug discovery and development. The market is projected to witness a CAGR of around nan% during the forecast period of nan-nan, reaching a value of nan billion by nan. Flow cytometry is a powerful technique used in cell analysis, biomarker detection, and protein engineering, making it a vital tool in research, clinical diagnostics, and drug development.

**Segments**

The North America Flow Cytometry Market can be segmented based on technology, product service, application, end-user, and country. By technology, the market is categorized into cell-based flow cytometry and bead-based flow cytometry. The cell-based flow cytometry segment is expected to dominate the market, owing to its wide range of applications in immunophenotyping, cell sorting, and cell cycle analysis. Based on product service, the market can be divided into reagents consumables, instruments, software, services, and accessories. The reagents consumables segment holds a significant market share due to the continuous need for these products in flow cytometry procedures. In terms of application, the market includes research applications, clinical applications, and industrial applications. The research applications segment is anticipated to lead the market, driven by the increasing research activities in fields such as immunology, oncology, and stem cell research. By end-user, the market is segmented into academic research institutes, hospitals clinical testing laboratories, pharmaceutical biotechnology companies, and others. The academic research institutes segment is expected to witness substantial growth, supported by government funding for research projects and collaborations with industry players.

**Market Players**

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Luminex Corporation

- Miltenyi Biotec

- Sysmex Corporation

- Bio-Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Sony Biotechnology Inc.

The North America Flow Cytometry Market is highly competitive, with key players focusing on strategic initiatives such as product launches, partnerships, and acquisitions to strengthen their market position. Technological advancements such as the integration of artificial intelligence and machine learning in flow cytometry systems are expected to drive market growth. However, challenges such as high instrument costs, lack of skilled professionals, and stringent regulatory requirements may hinder market expansion.

In conclusion, the North America Flow Cytometry Market is poised for substantial growth, driven by the increasing demand for advanced cell analysis techniques in various applications. With ongoing research and development activities in the region and the presence of major market players, the market is expected to witness significant advancements in the coming years.

https://www.databridgemarketresearch.com/reports/north-america-flow-cytometry-market

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies in North America Flow Cytometry Market : https://www.databridgemarketresearch.com/reports/north-america-flow-cytometry-market/companies

Key Questions Answered by the Global North America Flow Cytometry Market Report:

- What are the global trends in the North America Flow Cytometry Market?

- Will the market witness an increase or decline in demand in the coming years?

- What is the estimated demand for different types of products in the North America Flow Cytometry Market?

- What are the upcoming industry applications and trends for the North America Flow Cytometry Market?

- What are projections of the global North America Flow Cytometry Market industry considering capacity, production, and production value?

- What will be the estimated cost and profit? What will be the market share, supply, and consumption? What about import and export?

- Where will strategic developments take the industry in the mid to long term?

- What factors contribute to the final price of North America Flow Cytometry Market products?

- What are the key raw materials used in North America Flow Cytometry Market manufacturing?

- How big is the opportunity for the North America Flow Cytometry Market?

- How do industry statistics reflect recent changes in consumer behavior?

- What are the top emerging industry trends shaping the future of the North America Flow Cytometry Market?

Browse More Reports:

https://www.databridgemarketresearch.com/reports/europe-vanilla-beans-and-extracts-market

https://www.databridgemarketresearch.com/reports/global-hysteroscopes-and-hysteroscopic-fluid-management-systems-market

https://www.databridgemarketresearch.com/reports/north-america-gluten-free-breakfast-cereals-market

https://www.databridgemarketresearch.com/reports/asia-pacific-uv-curing-system-market

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-protective-gloves-market

Data Bridge Market Research:

☎ Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 982

✉ Email: corporatesales@databridgemarketresearch.com

Tag

North America Flow Cytometry Market Size, North America Flow Cytometry Market Share, North America Flow Cytometry Market Trend, North America Flow Cytometry Market Analysis, North America Flow Cytometry Market Report, North America Flow Cytometry Market Growth, Latest Developments in North America Flow Cytometry Market, North America Flow Cytometry Market Industry Analysis, North America Flow Cytometry Market Key Players, North America Flow Cytometry Market Demand Analysis"