"Cryptocurrency Custody Software Market Size And Forecast by 2031

Demand for Cryptocurrency Custody Software Market solutions is fueled by technological advancements and changing consumer preferences, creating new opportunities for companies. The market’s future scope looks promising, with revenue forecasts indicating substantial growth in the coming years. Leaders in the industry are focusing on strategic investments to maintain their competitive edge. Challenges such as regulatory constraints and economic volatility persist, but businesses are addressing them through innovative approaches. A detailed research report provides an overview of these dynamics.

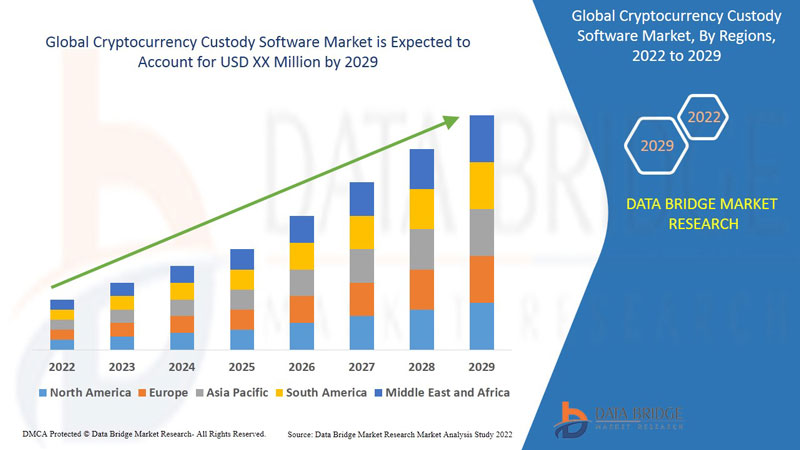

Data Bridge Market Research analyses that the cryptocurrency custody software market will exhibit a CAGR of 6.80% for the forecast period of 2022-2029.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-cryptocurrency-custody-software-market

Which are the top companies operating in the Cryptocurrency Custody Software Market?

The global Cryptocurrency Custody Software Market study presents a detailed analysis of the industry, focusing on key trends, market dynamics, and the competitive landscape. It highlights leading companies in the market, examining their strategies and contributions to market share. Additionally, the report offers insights into the Top 10 Companies in Cryptocurrency Custody Software Market in the Cryptocurrency Custody Software Market, including their business strategies, financial performance, and overall market position.

**Segments**

- **By Component:** The market is segmented into software and services. The software segment is expected to witness significant growth due to the increasing need for secure storage solutions in the cryptocurrency space.

- **By Deployment Mode:** On-premises and cloud-based are the two main deployment modes in the market. The cloud-based segment is anticipated to dominate the market as it offers scalability and flexibility to cryptocurrency custodians.

- **By Application:** The market is divided into exchanges, enterprises, and institutional investors. The institutional investors segment is projected to experience substantial growth as more traditional financial institutions begin to adopt and invest in cryptocurrencies.

**Market Players**

- **BitGo, Inc.:** BitGo is a prominent player in the cryptocurrency custody software market, offering secure storage solutions for digital assets. The company's advanced security features make it a preferred choice for institutional clients.

- **Coinbase, Inc.:** Coinbase is a well-known cryptocurrency exchange that also provides custody services for digital assets. Its custody offering is trusted by both retail and institutional clients due to its robust security measures.

- **Anchorage Hold, Inc.:** Anchorage is a leading provider of digital asset custody solutions. The company focuses on offering institutional-grade security and compliance features to safeguard clients' assets.

- **Gemini Trust Company, LLC:** Gemini is a popular cryptocurrency exchange that also offers custody services for various digital assets. The company's focus on regulatory compliance and security has earned it the trust of institutional investors.

- **Trustology:** Trustology is an innovative player in the market, offering cutting-edge custody solutions for digital assets. The company's technology-driven approach sets it apart in the competitive landscape of cryptocurrency custody.

The global cryptocurrency custody software market is experiencing rapid growth, driven by the increasing interest in digital assets from institutional investors and the need for secure storage solutions. Key players in the market such as BitGo, Coinbase, Anchorage, Gemini, and Trustology are focusing on enhancing their security features and compliance measuresThe global cryptocurrency custody software market is witnessing significant growth, driven by the rising demand for secure storage solutions in the cryptocurrency space. The market segmentation by component into software and services highlights the increasing adoption of secure storage software solutions due to the critical need for safeguarding digital assets. The software segment is expected to experience substantial growth as custodians prioritize advanced security features to protect cryptocurrencies from cyber threats and hacking attempts.

In terms of deployment modes, the market is divided into on-premises and cloud-based solutions. The cloud-based segment is projected to dominate the market as it offers scalability and flexibility to cryptocurrency custodians. Cloud-based solutions provide real-time access to digital assets, enhance operational efficiency, and offer cost-effective storage options. As a result, more custodians are opting for cloud-based deployment modes to meet the growing demands for secure and efficient storage solutions in the cryptocurrency industry.

The market segmentation by application into exchanges, enterprises, and institutional investors reveals a shift towards institutional adoption of cryptocurrencies. The institutional investors segment is expected to witness significant growth as traditional financial institutions recognize the potential of digital assets as investment opportunities. As institutional investors seek secure and compliant custody solutions, market players such as BitGo, Coinbase, Anchorage, Gemini, and Trustology are focusing on enhancing their security features and compliance measures to cater to this growing segment.

BitGo, Inc. is a prominent player in the market, known for its advanced security features and secure storage solutions tailored for institutional clients. Coinbase, Inc. and Gemini Trust Company, LLC also offer trusted custody services for digital assets, catering to both retail and institutional clients. Anchorage Hold, Inc. distinguishes itself by providing institutional-grade security and compliance features to safeguard clients' assets, while Trustology stands out for its innovative technology-driven approach to custody solutions.

Overall, the global cryptocurrency custody software market is characterized by intense competition among key players to enhance security features, compliance measures, and regulatory standards. As institutional interest in cryptocurrencies continues to grow, custodians are**Market Players**

Some of the major players operating in the cryptocurrency custody software market include BitGo, Coinbase, Key Safe, Kingdom Trust, WatermelonBlock.io, FMR LLC, Ledger SAS, itBit Trust Company, LLC, Base Zero, Inc., Gemini Trust Company, LLC, Paxos Trust Company, LLC, NVIDIA Corporation, Bitfury Group Limited, GENERAL BYTES s.r.o., Genesis Coin, Lamassu Industries AG, COVAUL, Bitaccess, Coinme Inc., Coinsource, Bitxatm, and Xilinx among others.

The global cryptocurrency custody software market is witnessing remarkable growth, primarily driven by the increasing interest of institutional investors in digital assets and the necessity for secure storage solutions. The market segments by component, deployment mode, and application provide insights into the key factors influencing the market dynamics and growth opportunities for the players. The software segment, with its focus on advanced security features, is expected to grow significantly as custodians prioritize safeguarding digital assets from cyber threats.

Cloud-based deployment modes are anticipated to dominate the market due to their scalability and flexibility, catering to the evolving needs of cryptocurrency custodians. These solutions offer real-time access, operational efficiency, and cost-effective storage options, further boosting their adoption across the industry. As institutional investors increasingly recognize cryptocurrencies as viable investment opportunities, the segment dedicated to them is poised for substantial growth, creating new avenues for market players to capitalize on this trend.

Key players such as BitGo, Coinbase, Anch

Explore Further Details about This Research Cryptocurrency Custody Software Market Report https://www.databridgemarketresearch.com/reports/global-cryptocurrency-custody-software-market

Why B2B Companies Worldwide Choose Us for Revenue Growth and Sustainability

- Gain a clear understanding of the Cryptocurrency Custody Software Market, its operations, and stages in the value chain.

- Explore the current market scenario and assess future growth potential throughout the forecast period.

- Strategize effectively for marketing, market entry, expansion, and business plans by analyzing growth factors and buyer behavior.

- Stay ahead of competitors by studying their business models, strategies, and prospects.

- Make data-driven decisions with access to comprehensive primary and secondary research.

Key Insights from the Global Global Cryptocurrency Custody Software Market :

- Comprehensive Market Overview: A detailed examination of the global Cryptocurrency Custody Software Market.

- Industry Trends and Projections: Analysis of historical data (2015 onward) and future growth forecasts, including compound annual growth rates (CAGRs).

- Emerging Opportunities: Identification of new market prospects and targeted marketing strategies.

- Focus on RD: Insights into demand for new product launches and innovative applications.

- Leading Player Profiles: Detailed profiles of major market participants.

- Market Composition: Analysis of dynamic molecule types, targets, and key resources.

- Revenue Growth: Examination of global market revenue, segmented by key players and product categories.

- Commercial Opportunities: Analysis of sales trends, licensing deals, and co-development opportunities.

Regional Insights and Language Accessibility

- North America: United States, Canada, Mexico

- Europe: Germany, France, UK, Russia, Italy

- Asia-Pacific: China, Japan, Korea, India, Southeast Asia

- South America: Brazil, Argentina, Colombia, and others

- Middle East and Africa: Saudi Arabia, UAE, Egypt, Nigeria, South Africa

Understanding market trends at a regional level is crucial for effective decision-making. Our reports cater to diverse audiences by offering localized analyses in multiple regional languages. These reports provide tailored insights for specific regions, enabling businesses and stakeholders to access relevant information for informed strategies. By bridging communication gaps, we empower regional markets to thrive and grow. Access our reports in your preferred language for a personalized understanding of industry dynamics.

Japanese : https://www.databridgemarketresearch.com/jp/reports/global-cryptocurrency-custody-software-market

Chinese : https://www.databridgemarketresearch.com/zh/reports/global-cryptocurrency-custody-software-market

Arabic : https://www.databridgemarketresearch.com/ar/reports/global-cryptocurrency-custody-software-market

Portuguese : https://www.databridgemarketresearch.com/pt/reports/global-cryptocurrency-custody-software-market

German : https://www.databridgemarketresearch.com/de/reports/global-cryptocurrency-custody-software-market

French : https://www.databridgemarketresearch.com/fr/reports/global-cryptocurrency-custody-software-market

Spanish : https://www.databridgemarketresearch.com/es/reports/global-cryptocurrency-custody-software-market

Korean : https://www.databridgemarketresearch.com/ko/reports/global-cryptocurrency-custody-software-market

Russian : https://www.databridgemarketresearch.com/ru/reports/global-cryptocurrency-custody-software-market

Data Bridge Market Research:

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975