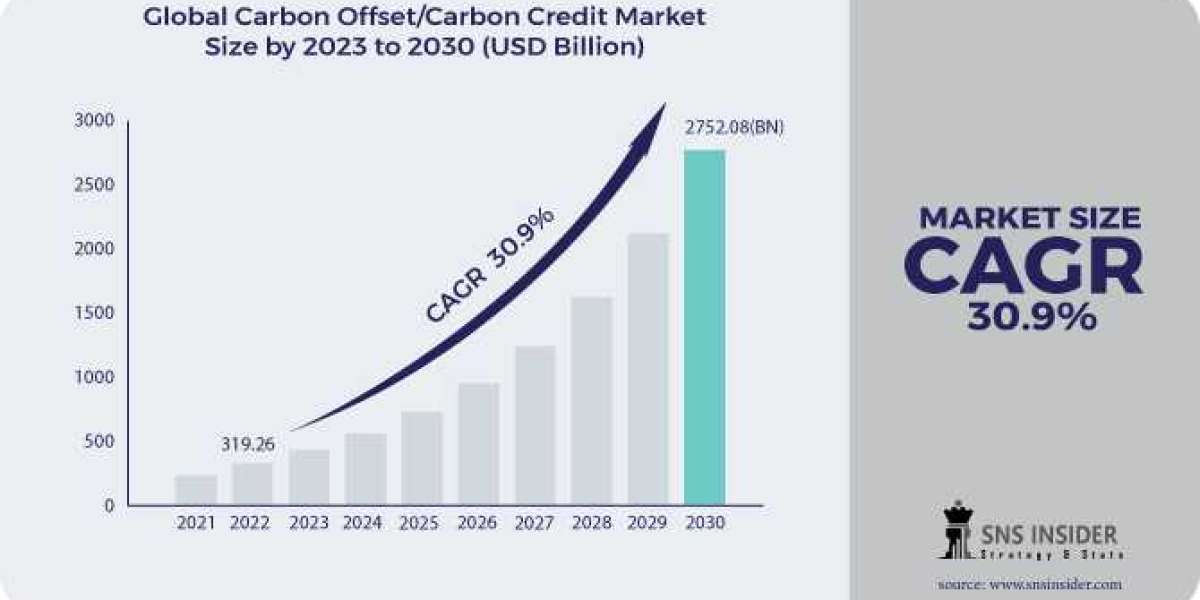

The Carbon Offset/Carbon Credit Market is gaining momentum as governments, businesses, and individuals increasingly prioritize carbon-neutral goals to mitigate climate change. The market serves as a key tool for balancing greenhouse gas (GHG) emissions through the trading of carbon credits, which represent measurable reductions or removals of CO₂ from the atmosphere.

Market Segmentation

By Type

Voluntary Market

Driven by corporate sustainability goals and consumer awareness.

Predominantly utilized by private entities and individuals seeking carbon neutrality.

Compliance Market

Regulated by government-mandated cap-and-trade systems.

Enforced in regions with stringent emission reduction policies like the EU and California.

By Project Type

Removal Projects

Projects that directly remove CO₂ from the atmosphere, such as reforestation and direct air capture.

Gaining attention for their long-term climate benefits.

Avoidance/Reduction Projects

Focused on preventing emissions through renewable energy, energy efficiency, and waste management initiatives.

Comprise the majority of current projects due to cost efficiency and scalability.

By End-User

Energy

Energy producers invest in offsets to mitigate emissions from fossil fuel-based operations.

Renewable energy projects often generate carbon credits for sale.

Transportation

Airlines, shipping companies, and ride-sharing platforms purchase credits to offset vehicle and fleet emissions.

Aviation

Industry initiatives like CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation) boost demand for credits.

Power

Utilities engage in credit trading to meet regulatory requirements and transition to green energy.

Buildings

Real estate developers and property managers utilize credits to offset operational emissions from buildings.

Industrial

Heavy industries like manufacturing, steel, and cement are significant buyers due to their high carbon footprints.

Others

Includes agriculture, forestry, and municipal sectors exploring offset solutions.

By Region

North America

The U.S. and Canada lead the voluntary market, with robust corporate participation.

State-level initiatives and federal incentives support market growth.

Europe

Compliance market dominance, driven by the EU Emissions Trading System (ETS).

Strong adoption of removal projects in forestry and carbon capture.

Asia-Pacific

Rapid expansion due to growing industrial activity and regional climate commitments.

Notable contributions from China’s national carbon market.

Middle East Africa

Focus on carbon credits from renewable energy and desert reforestation projects.

Rising participation from oil-producing nations.

Latin America

Significant contributions from reforestation and renewable energy initiatives.

Brazil and Mexico emerge as key markets.

Market Drivers

Global Climate Commitments

Adoption of international agreements like the Paris Accord drives compliance and voluntary markets.

Corporate Sustainability Goals

Businesses increasingly use carbon credits to achieve net-zero objectives.

Growth in Green Technologies

Renewable energy and carbon capture projects create new opportunities for credit generation.

Trends

Expansion of Nature-Based Solutions

Growing preference for forestry and soil carbon sequestration projects.

Blockchain Integration

Enhances transparency and traceability in credit trading systems.

Carbon Credit Tokenization

Facilitates smaller, more accessible trades for diverse stakeholders.

Challenges

Lack of Standardization

Varying rules and methodologies hinder market uniformity.

Verification Issues

Ensuring the credibility and permanence of offset projects remains a concern.

Pricing Volatility

Fluctuations in credit prices affect market stability.

Market Outlook

The Carbon Offset/Carbon Credit Market is poised for substantial growth through 2031 as global decarbonization efforts intensify. Innovation in project types, regional collaboration, and technological advancements will play pivotal roles in shaping the market’s trajectory, ensuring its critical contribution to combating climate change.

Read Complete Report Details of Carbon Offset/Carbon Credit Market: https://www.snsinsider.com/reports/carbon-offset-carbon-credit-market-2839

About Us:

SNS Insider is a global leader in market research and consulting, shaping the future of the industry. Our mission is to empower clients with the insights they need to thrive in dynamic environments. Utilizing advanced methodologies such as surveys, video interviews, and focus groups, we provide up-to-date, accurate market intelligence and consumer insights, ensuring you make confident, informed decisions.

Contact Us:

Akash Anand – Head of Business Development Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)