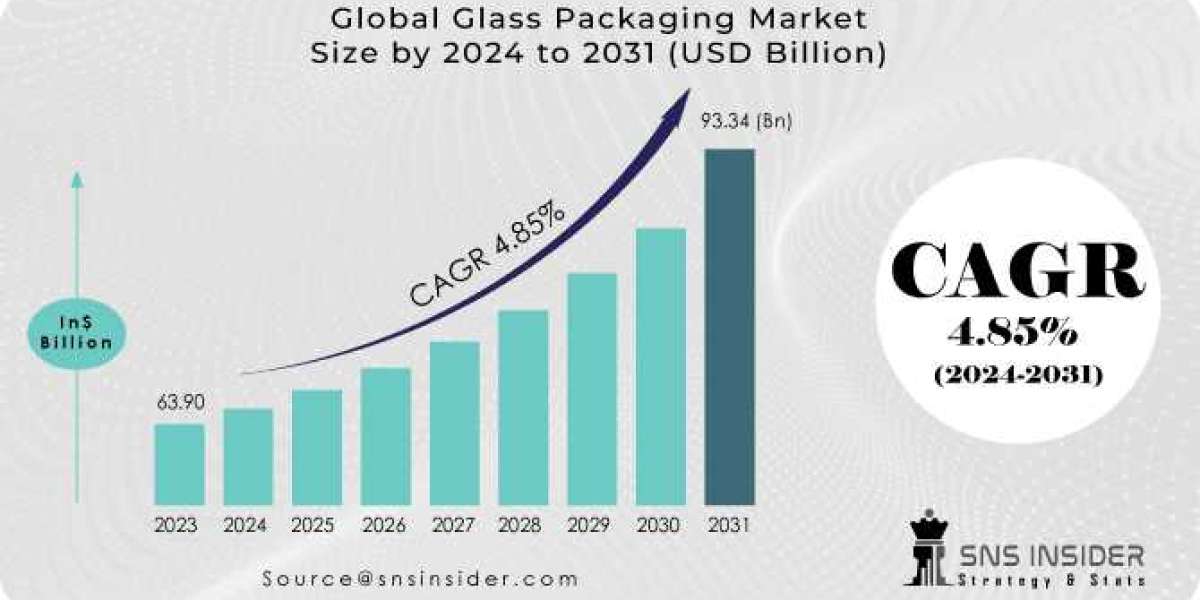

The global Glass Packaging Market Growth valued at USD 63.90 billion in 2023, is expected to experience substantial growth over the next decade. With the increasing demand for sustainable and premium packaging solutions across various industries, the is projected to reach USD 93.34 billion by 2031, expanding at a compound annual growth rate (CAGR) of 4.85% from 2024 to 2031.

Overview

Glass packaging has long been revered for its superior qualities, including its ability to preserve the taste, aroma, and integrity of products. As a material that is 100% recyclable, glass is highly valued for its sustainability, making it an ideal choice in an era where environmental consciousness is paramount. The for glass packaging spans across various industries, including beverages, cosmetics, pharmaceuticals, and food, with the beverage industry being the largest consumer.

The shift towards premiumization in products, especially in the beverage and cosmetic sectors, is driving the demand for glass packaging. Consumers increasingly associate glass with luxury, quality, and environmental responsibility, leading brands to adopt glass containers to enhance their product appeal.

Download Free Sample Report: https://www.snsinsider.com/sample-request/2921

Dynamics

The growth of the Glass Packaging is influenced by several key factors. A significant driver is the increasing consumer preference for sustainable packaging solutions. Glass, being infinitely recyclable without losing quality, stands out as one of the most eco-friendly packaging materials available. This characteristic is particularly appealing in today’s , where consumers are more environmentally conscious and prefer products that come in sustainable packaging.

The rise of the premium beverage , including alcoholic and non-alcoholic beverages, is another major factor propelling the . Premium alcoholic beverages like wine, spirits, and craft beers often use glass packaging to convey a sense of luxury and quality. Similarly, the demand for high-end non-alcoholic beverages, such as bottled water and specialty drinks, is driving the need for aesthetically pleasing and functional glass containers.

Technological advancements in glass manufacturing are also contributing to growth. Innovations that allow for lighter yet stronger glass packaging are reducing production costs and transportation emissions, making glass an even more attractive option for manufacturers.

Segmentation Analysis

The Glass Packaging is segmented by raw material, product type, application, and region. Each segment offers unique insights into the ’s dynamics and growth opportunities.

By Raw Material:

- Cullet:Cullet, or recycled glass, is a key raw material in the production of new glass packaging. The use of cullet not only reduces the demand for raw materials but also lowers energy consumption during manufacturing. The growing emphasis on recycling and the circular economy is driving the demand for cullet in glass production.

- Cobalt Oxide:Used primarily in the production of colored glass, cobalt oxide is essential for creating distinct hues that enhance product differentiation in the . The demand for colored glass, particularly in the beverage and cosmetics industries, is boosting the use of cobalt oxide.

- Limestone:Limestone is a crucial component in glass production, providing the necessary calcium oxide that helps stabilize the glass structure. The availability and cost of limestone are significant factors influencing the overall cost of glass packaging.

- Others:This category includes various other raw materials such as silica sand, soda ash, and feldspar, which are integral to the glass manufacturing process. The quality and consistency of these materials are vital for producing high-quality glass packaging.

By Product Type:

- Bottles Jars:Bottles and jars represent the largest segment in the glass packaging , driven by their widespread use in the beverage, food, and cosmetic industries. The ability of glass bottles and jars to preserve the freshness and quality of products makes them a preferred choice for manufacturers and consumers alike.

- Containers:Glass containers, including those used for pharmaceuticals and chemicals, are valued for their inert nature, which ensures that the contents are not contaminated or altered by the packaging material. The demand for glass containers is particularly strong in the pharmaceutical sector, where product safety is paramount.

- Vials:Vials are small glass containers used primarily for pharmaceuticals, essential oils, and other high-value liquids. The precision and safety offered by glass vials are critical in these applications, making them a staple in the healthcare and wellness industries.

- Others:This segment includes various other forms of glass packaging, such as ampoules and tubes, used across a range of industries. The versatility of glass as a packaging material allows for its application in numerous specialized products.

By Application:

- Alcoholic Beverages:The alcoholic beverage industry is the largest consumer of glass packaging, with products like wine, spirits, and beer often packaged in glass to preserve flavor and provide a premium appearance. The trend towards craft beverages and premiumization is further driving the demand for glass bottles in this segment.

- Non-Alcoholic Beverages:In the non-alcoholic beverages sector, glass is increasingly used for products like juices, soft drinks, and bottled water. The perceived purity and quality of glass packaging make it a popular choice for health-conscious consumers.

- Cosmetics:The cosmetics industry values glass packaging for its ability to protect sensitive formulations from contamination and degradation. The luxurious feel and appearance of glass also align with the premium positioning of many cosmetic brands.

- Others:This segment covers a wide range of applications, including pharmaceuticals, food products, and household items. Glass packaging’s inert nature and recyclability make it suitable for a variety of uses where product safety and sustainability are priorities.

Regional Analysis

Geographically, the Glass Packaging is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East Africa. Each region presents unique growth opportunities and challenges.

- North America:North America is a leading for glass packaging, driven by strong demand in the beverage and pharmaceutical industries. The U.S. is a major player in the , with significant investments in sustainable packaging solutions and advanced glass manufacturing technologies.

- Europe:Europe is another significant , with a strong focus on sustainability and recycling. Countries like Germany, France, and Italy are leading the way in glass packaging adoption, particularly in the premium beverage sector. The region’s stringent environmental regulations are also driving the demand for eco-friendly packaging solutions.

- Asia-Pacific:The Asia-Pacific region is expected to witness the fastest growth in the glass packaging , driven by the expanding middle class, rising disposable incomes, and the growing demand for premium products. China and India are key s, with increasing consumption of both alcoholic and non-alcoholic beverages.

- Latin America:The in Latin America is growing steadily, with Brazil and Mexico leading the way in adopting glass packaging solutions. The region’s beverage industry, particularly in beer and spirits, is driving demand for glass bottles and containers.

- Middle East Africa:The Glass Packaging in the Middle East Africa is in the early stages of growth, with increasing awareness of the benefits of glass packaging driving demand. The region presents significant growth potential, particularly in the food and beverage sectors.

Key Players and Competitive Landscape

The Glass Packaging is highly competitive, with several key players vying for share. Leading companies in the include Owens-Illinois Inc., Ardagh Group S.A., Verallia, Vidrala, and Nihon Yamamura Glass Co., Ltd., among others. These companies are focusing on innovation, sustainability, and strategic partnerships to strengthen their positions.

Recent Developments

- Sustainability Initiatives:Leading companies are investing in the development of sustainable glass packaging solutions, including the use of lightweight glass and increased cullet content. These initiatives are aimed at reducing the environmental impact of glass production and meeting the growing demand for eco-friendly packaging.

- Technological Advancements:Innovations in glass manufacturing, such as the development of thinner yet stronger glass, are gaining traction in the . These advancements are helping companies reduce costs while maintaining the quality and durability of their products.

- Expansion into Emerging s:Key players are expanding their operations in emerging s, particularly in Asia-Pacific and Latin America, to capitalize on the growing demand for glass packaging. These regions offer significant growth opportunities, driven by rising consumer incomes and expanding beverage sectors.

Conclusion

The Glass Packaging is set to experience robust growth over the next decade, driven by increasing demand in the beverage and cosmetic industries. As the evolves, companies that invest in sustainability and innovation will be well-positioned to capture significant share and drive long-term growth. With the ongoing shift towards eco-friendly packaging solutions and continuous advancements in glass manufacturing technologies, the future of the glass packaging looks promising.

Read More Details @ https://www.snsinsider.com/reports/glass-packaging-market-2921

Contact Us:

Akash Anand – Head of Business Development Strategy

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)