IMARC Group has recently released a new research study titled “Mexico Graphite Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

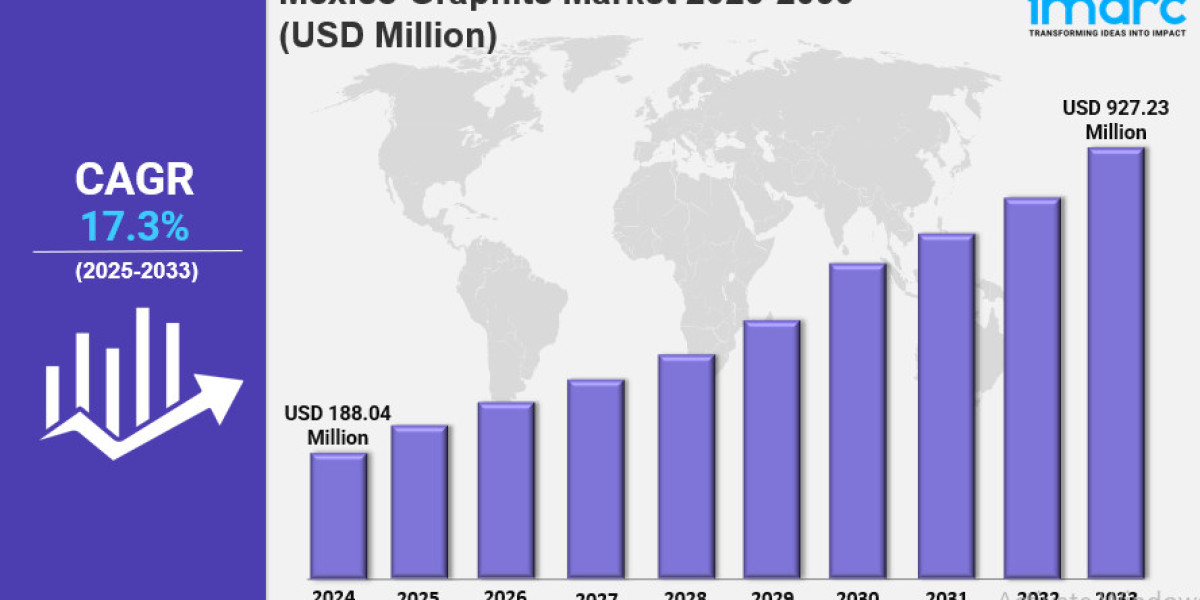

The Mexico graphite market size reached USD 188.04 Million in 2024 and is projected to reach USD 927.32 Million by 2033. The market is expected to grow at a CAGR of 17.3% during the forecast period 2025-2033. Increasing demand in electric vehicle (EV) batteries, renewable energy storage, and industrial applications, along with Mexico’s expanding mining activities and investments in clean technologies, are key growth contributors. Advancements in battery technology further drive positive market momentum. Mexico Graphite Market

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Mexico Graphite Market Key Takeaways

- Current Market Size (2024): USD 188.04 Million

- CAGR (2025-2033): 17.3%

- Forecast Period: 2025-2033

- The graphite electrode market in Mexico is growing as companies expand distribution networks to meet rising demand from steel manufacturing and energy production sectors.

- Increasing focus on delivering ISO-certified graphite electrodes ensures high quality and reliability for industrial applications.

- Mexico’s strategic location enhances its role as a key distribution hub in North America.

- Growing demand for eco-friendly graphite solutions driven by sustainability awareness and environmental regulations in industrial sectors.

- Shift toward graphite materials with reduced carbon emissions and increased recycled content to minimize environmental impact.

Sample Request Link: https://www.imarcgroup.com/mexico-graphite-market/requestsample

Mexico Graphite Market Growth Factors

The Mexico graphite market growth is primarily fueled by increasing demand for graphite in electric vehicle (EV) batteries, renewable energy storage, and industrial applications. These growing sectors require high-performance materials, and graphite electrodes are essential components in battery and energy storage technologies. The report highlights a compound annual growth rate (CAGR) of 17.3% during 2025-2033, reflecting expanding demand driven by Mexico’s growing mining activities and investments in clean technologies. This creates opportunities for the graphite market to flourish alongside advancements in battery and electrode production technologies.

The graphite electrode market in Mexico is experiencing expansion due to companies enhancing their distribution networks to satisfy demand from steel manufacturing and energy production industries. Graphite electrodes play a crucial role in electric arc furnaces extensively used for steel production. With rising industry needs for efficient and durable graphite electrodes, suppliers are focusing on ISO-certified products and strengthening supply chains for quicker and reliable delivery. Mexico’s strategic geographic location in North America further supports its position as a hub for regional and international graphite electrode distribution.

Sustainability concerns and environmental impact awareness are also significantly influencing the Mexico graphite market. There is a noticeable shift toward eco-friendly graphite solutions driven by steel manufacturing, battery production, and automotive sectors aiming to reduce carbon footprints. Manufacturers are increasingly adopting green manufacturing practices such as lowering carbon emissions and using recycled materials during graphite electrode production. This demand for cleaner, more sustainable graphite products is reshaping the market and attracting suppliers to develop advanced, eco-conscious materials aligned with environmental standards and regulations.

To get more information on this market, Request Sample

Mexico Graphite Market Segmentation

Breakup by Type:

- Natural Graphite: Covers graphite mined directly from natural sources and used in various industrial applications requiring raw graphite materials.

- Synthetic Graphite (FLG): Includes fabricated graphite used primarily where specific quality and performance characteristics are required beyond natural graphite capabilities.

Breakup by Application:

- Electrodes: Graphite electrodes employed in electric arc furnaces and battery manufacturing, critical for industrial energy processes.

- Refractories, Casting, and Foundries: Graphite used in thermal resistant and mold making applications within metallurgy and metal casting industries.

- Batteries: Graphite materials functioning as essential components in lithium-ion and other advanced battery technologies.

- Lubricants: Graphite employed as a dry lubricant in industrial machinery and automotive applications.

- Others: Covers other miscellaneous applications of graphite not included in the above segments.

Breakup by End Use Industry:

- Electronics: Use of graphite in electronic devices, components, and semiconductor applications.

- Metallurgy: Usage in metal processing, steel production, and related industries where graphite plays a role.

- Automotive: Graphite utilized in vehicle manufacturing, particularly in batteries and lubricants.

- Others: Other industrial sectors employing graphite for various specialized applications.

Breakup by Region

The report identifies Northern Mexico, Central Mexico, Southern Mexico, and others as significant regions within the country’s graphite market. However, specific dominant region statistics such as market share or CAGR by region are not provided in the source. Mexico’s strategic position in North America enhances its role as a hub for graphite electrode distribution and federation of stronger market connections regionally and internationally.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=36089&flag=C

Recent Developments & News

In March 2025, FRC Global became Dantan Carbon’s premier distributor of graphite electrodes in Mexico, expanding access to high-quality, ISO9001-certified electrodes. Additionally, in March 2025, Metcar announced that its M-161 and M-310 carbon graphite materials would be distributed globally by Boulden Company. These materials are vital for reliable pump operations in utilities, oil and gas, and petrochemical sectors, offering self-lubricating properties to prevent galling and seizing. Metcar’s manufacturing facilities in Mexico bolster its capacity to supply engineered graphite solutions worldwide.

Key Players

- FRC Global

- Dantan Carbon

- Metcar

- Boulden Company

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302