Budgeting is the cornerstone of financial stability, enabling you to manage your money effectively, reduce financial stress, and work toward your financial goals. A safe and realistic budget helps you cover daily expenses, plan for emergencies, and save for the future. In this blog, we’ll explore practical strategies to implement safe budgeting practices into your daily life.

1. Understand Your Income and Expenses

The first step to effective budgeting is knowing how much money you earn and where it goes.

Steps to Track Income and Expenses:

Calculate Your Income: Include all sources of income, such as salary, side gigs, or passive income.

List Fixed Expenses: Identify recurring costs like rent, utilities, and insurance.

Track Variable Expenses: Keep an eye on discretionary spending, such as dining out and entertainment.

Action Steps:

Use budgeting apps like Mint or YNAB (You Need A Budget) to track your cash flow.

Review your bank statements to identify spending patterns.

2. Set Financial Goals

Your budget should align with your financial goals. Clear objectives help you stay focused and motivated.

Types of Goals:

Short-Term Goals: Building an emergency fund or paying off credit card debt.

Medium-Term Goals: Saving for a vacation or purchasing a car.

Long-Term Goals: Planning for retirement or buying a home.

Action Steps:

Write down SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound).

Break larger goals into smaller, actionable steps.

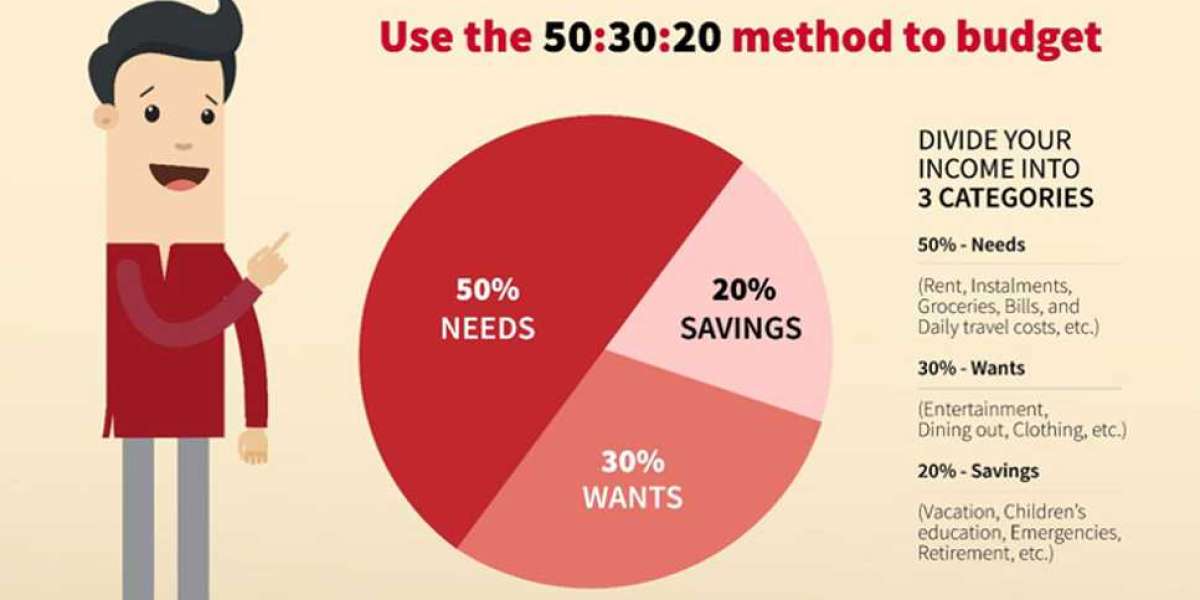

3. Adopt the 50/30/20 Rule

The 50/30/20 rule is a simple budgeting framework that allocates your income into three categories:

50% for Needs: Essential expenses like rent, groceries, and healthcare.

30% for Wants: Non-essential spending, such as hobbies or entertainment.

20% for Savings and Debt Repayment: Building savings or paying down debt.

Action Steps:

Evaluate your current spending against these percentages.

Adjust your budget to prioritize savings and essential expenses.

4. Build an Emergency Fund

An emergency fund is your financial safety net, protecting you from unexpected expenses like medical bills or car repairs.

Emergency Fund Tips:

Aim to save 3-6 months' worth of living expenses.

Keep your emergency fund in a high-yield savings account for easy access.

Action Steps:

Automate monthly transfers to your emergency fund.

Start small; even saving $10-$20 a week adds up over time.

5. Limit Impulse Spending

Impulse purchases can derail your budget quickly. Learning to control unnecessary spending is key to staying on track.

Strategies to Curb Impulse Spending:

Create a 24-hour rule: Wait a day before making non-essential purchases.

Shop with a list to avoid buying items you don’t need.

Unsubscribe from promotional emails to reduce temptation.

Action Steps:

Use cash instead of credit cards for discretionary spending.

Set spending limits for entertainment and dining out.

6. Use Budgeting Tools

Technology can simplify budgeting by helping you track expenses, monitor progress, and stay organized.

Recommended Tools:

Apps: Mint, PocketGuard, or EveryDollar.

Spreadsheets: Use templates from Google Sheets or Excel.

Envelopes: For a cash-only budgeting system, allocate money into labeled envelopes for each category.

Action Steps:

Explore different tools and choose one that fits your needs.

Update your budget regularly to reflect changes in income or expenses.

7. Reduce Debt Strategically

Debt repayment should be a priority in your budget. By reducing debt, you free up more income for savings and other goals.

Debt Repayment Methods:

Snowball Method: Pay off smaller debts first for quick wins.

Avalanche Method: Focus on high-interest debts to save on interest.

Action Steps:

List all your debts, including balances, interest rates, and minimum payments.

Allocate extra funds toward the debt with the highest priority.

8. Plan for Irregular Expenses

Irregular expenses, such as holiday gifts or annual subscriptions, can disrupt your budget if you’re not prepared.

Planning Tips:

Create a sinking fund for predictable irregular expenses.

Divide the total cost by the number of months until the expense is due and save accordingly.

Action Steps:

Set aside a small amount each month for irregular expenses.

Keep track of upcoming expenses in a planner or app.

9. Practice Frugal Living

Frugal living doesn’t mean depriving yourself but rather making intentional choices to maximize value.

Frugal Tips:

Cook meals at home instead of dining out.

Cancel unused subscriptions or memberships.

Shop during sales or buy second-hand items.

Action Steps:

Evaluate your monthly subscriptions and cancel those you rarely use.

Meal prep to save on dining expenses.

10. Review and Adjust Regularly

Budgeting is not a one-time activity. Regular reviews ensure your budget remains realistic and effective.

Review Tips:

Analyze your spending at the end of each month.

Adjust your budget to account for changes in income or expenses.

Action Steps:

Set a recurring calendar reminder to review your budget.

Celebrate small wins to stay motivated.

Conclusion

Safe budgeting is about creating a plan that works for your unique financial situation and sticking to it. By understanding your income and expenses, setting goals, and using practical tools, you can take control of your finances and achieve financial peace of mind. Start small, stay consistent, and remember that every step you take brings you closer to financial stability. Happy budgeting!