Market Overview 2025-2033

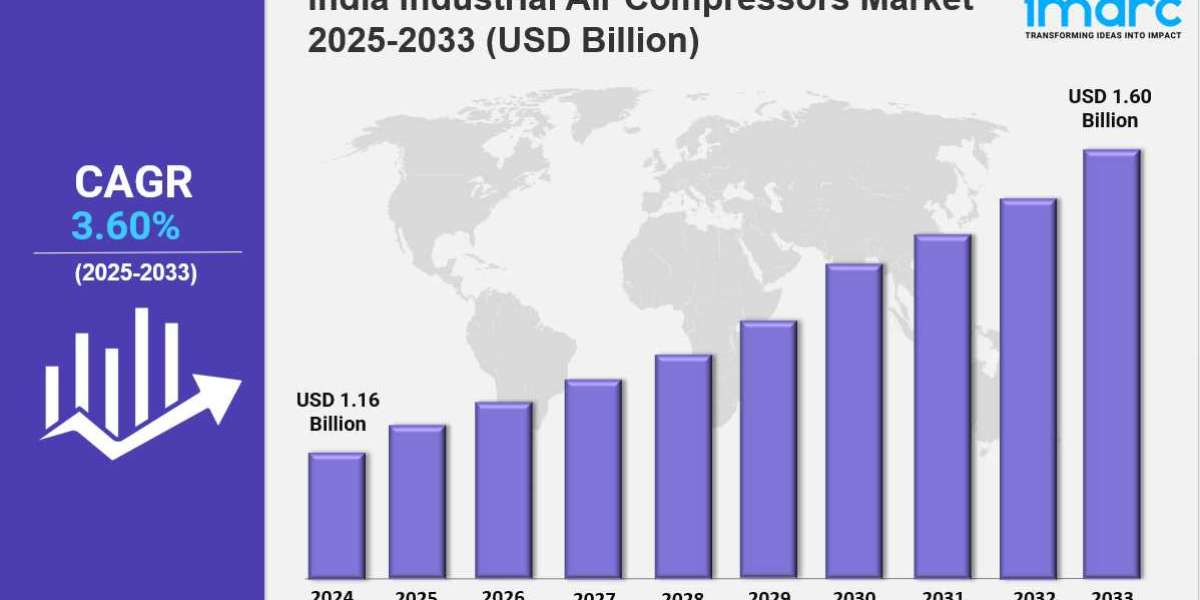

The India industrial air compressors market size reached USD 1.16 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.60 Billion by 2033, exhibiting a growth rate (CAGR) of 3.60% during 2025-2033. The market is growing due to increasing industrialization, rising demand for energy-efficient solutions, and advancements in compressor technology. Infrastructure development, manufacturing expansion, and government initiatives are key factors driving industry growth.

Key Market Highlights:

✔️ Strong market growth driven by increasing industrialization and manufacturing sector expansion

✔️ Rising demand for energy-efficient and oil-free air compressors

✔️ Expanding adoption in automotive, food processing, and pharmaceutical industries

Request for a sample copy of the report: https://www.imarcgroup.com/india-industrial-air-compressors-market/requestsample

India Industrial Air Compressors Market Trends and Drivers:

The India Industrial Air Compressors Market is growing quickly. This growth is due to rapid industrialization and infrastructure expansion. The government supports initiatives like “Make in India” and the Production-Linked Incentive (PLI) scheme. These efforts boost investments in sectors such as automotive, textiles, pharmaceuticals, and electronics. Air compressors are vital for powering pneumatic tools, machinery, and automation systems. As factories increase production, the demand for air compressors rises.

At the same time, large infrastructure projects—like highways, metro rail networks, and smart cities—drive the need for both portable and stationary compressors in construction. The automotive sector is a major user of compressors. They are used for painting, assembly lines, and tire inflation. The pharmaceutical industry prefers oil-free compressors to meet strict air quality standards. This demand from both manufacturing and infrastructure creates competition. Domestic and international companies are expanding their offerings to meet various industrial needs.

Sustainability demands and rising costs are driving industries to choose energy-efficient air compressors. In 2024, the Bureau of Energy Efficiency (BEE) set tougher star ratings for compressors. This change pushes manufacturers to innovate in variable speed drive (VSD) and oil-free technologies. Industries are now preferring VSD compressors. These machines adjust output based on real-time demand, cutting energy use by up to 35% compared to fixed-speed models.

For example, the food and beverage sector values oil-free compressors to avoid contamination. Meanwhile, the chemical industry looks for corrosion-resistant models to handle hazardous environments. Also, government subsidies from the National Mission on Enhanced Energy Efficiency (NMEEE) encourage small and medium enterprises (SMEs) to upgrade their old systems. This shift is changing market dynamics. Companies like Kirloskar Pneumatic and Atlas Copco are launching eco-friendly product lines to meet India’s net-zero goals.

The combination of IoT and predictive maintenance is changing compressor operations. New systems provide real-time monitoring of pressure, temperature, and energy use. This helps industries cut downtime and improve performance. For instance, in 2024, a major cement company achieved a 20% drop in maintenance costs. They used IoT-enabled compressors to identify problems before failures happened. Cloud-based platforms make remote diagnostics easier. Technicians can fix issues without needing to be onsite.

This digital shift is vital for industries that run 24/7, like steel and power generation. Unplanned shutdowns in these sectors can lead to huge revenue losses. As connectivity becomes essential, suppliers are teaming up with tech companies. They aim to integrate AI-driven analytics into their products, boosting operational efficiency even more. The India Industrial Air Compressors Market is changing fast. This shift is driven by economic growth, new regulations, and tech advancements. A major factor is the rebound in manufacturing after the pandemic. Government policies aim to make India a global manufacturing hub.

The PLI scheme, which started gaining traction in 2024, has drawn over $50 billion in investments across 14 sectors. This surge boosts demand for industrial machinery, including air compressors. At the same time, renewable energy projects—like solar parks and green hydrogen facilities—are increasing the need for compressors in gas processing and storage. Energy efficiency is a key focus, with industries upgrading to meet sustainability standards. In 2024, the BEE expanded its Standards Labeling Program to cover rotary screw compressors, pushing manufacturers to innovate.

Additionally, there is a rise in localized production. Global companies like Ingersoll Rand and Hitachi are setting up manufacturing units in Gujarat and Tamil Nadu to cut costs and delivery times. The market is set for consolidation as SMEs face new tech and regulatory demands. Industry 4.0 practices and rising automation in automotive and electronics will boost growth. Still, challenges like supply chain issues and changing raw material prices may slow this expansion. Despite these obstacles, the market is expected to grow at a CAGR of 6.8% over the next five years. This growth will be driven by India’s industrial modernization efforts and the global shift towards greener technologies.

India Industrial Air Compressors Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product:

- Reciprocating

- Rotary/Screw

- Centrifugal

Breakup by Lubrication:

- Oil-free

- Oil-Filled

Breakup by Operation:

- ICE

- Electric

Breakup by Capacity:

- Up to 100

- 101-200 kW

- 201-300 kW

- 301-500 kW

- 501 and Above

Breakup by End User:

- Oil and Gas

- Manufacturing

- Healthcare/Pharmaceutical

- Food and Beverage

- Energy and Utility

- Automotive

- Construction

- Others

Breakup by Regional:

- North India

- South India

- East India

- West India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145