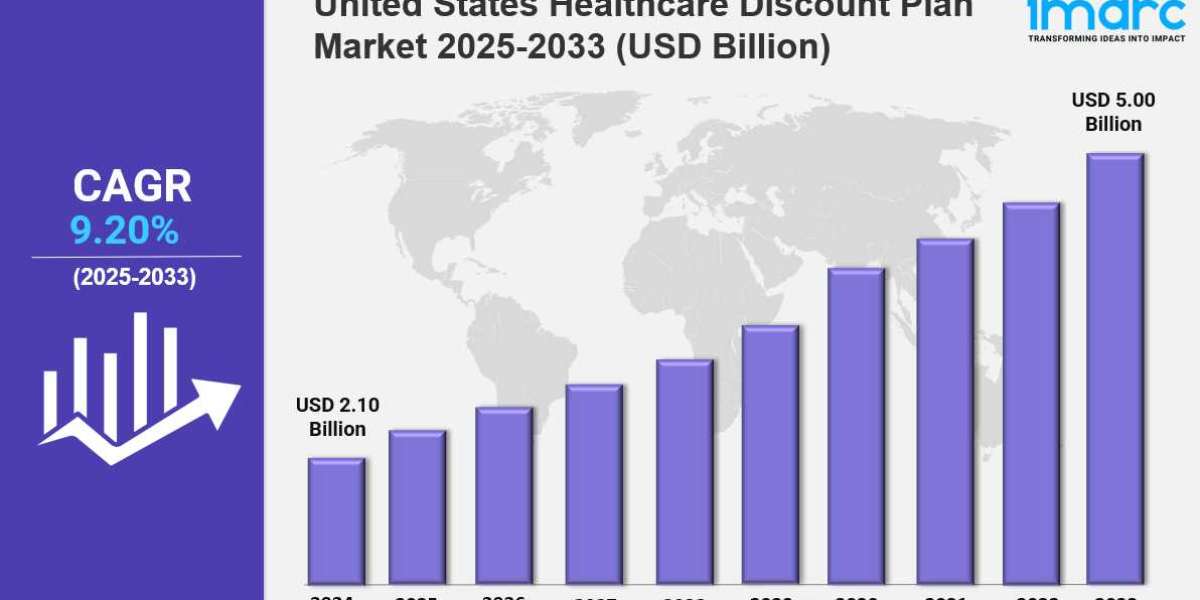

Market Overview 2025-2033

The United States healthcare discount plan market size reached USD 2.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.00 Billion by 2033, exhibiting a growth rate (CAGR) of 9.20% during 2025-2033. The market is expanding due to rising healthcare costs, increasing demand for affordable medical services, and growing consumer awareness. Digital platforms, employer-sponsored plans, and regulatory support are key factors driving industry growth.

Key Market Highlights:

✔️ Strong market growth driven by rising healthcare costs and demand for affordable medical services

✔️ Increasing adoption of subscription-based discount plans for dental, vision, and prescription services

✔️ Expanding partnerships between healthcare providers and discount plan networks

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-healthcare-discount-plan-market/requestsample

United States Healthcare Discount Plan Market Trends and Drivers:

The United States Healthcare Discount Plan Market is growing fast. This growth comes from rising out-of-pocket medical costs and gaps in traditional insurance. As deductibles and copayments increase, middle-income families and uninsured people are turning to discount plans for help. In 2024, a Kaiser Family Foundation study found that 43% of adults under 65 had trouble paying medical bills. This has led to a higher demand for cost-saving tools.

Discount plans offer negotiated rates on prescriptions, dental, vision, and telehealth services. Many see these plans as crucial, especially gig economy workers and early retirees without employer-sponsored coverage. Providers like GoodRx and Careington International report a 22% growth in memberships. This highlights a shift towards hybrid coverage models. At the same time, insurers like Cigna and Aetna are adding discount networks to high-deductible plans. This move aims to enhance value and shows deeper integration into mainstream healthcare.

Technology is changing how discount plans are shared and used. AI platforms now look at individual health profiles to suggest custom bundles. These often combine medication discounts with local dental care or mental health services. In 2024, startups like HealthAxis and WellWallet launched apps that use machine learning to forecast users’ future health needs. They also adjust plan suggestions on the fly.

Telehealth partnerships are growing too. A McKinsey survey found that 58% of discount providers now offer virtual primary care consults. This shift meets younger users’ desire for on-demand, app-based solutions. It also helps insurers cut down on administrative costs. Yet, cybersecurity risks are a major concern. The Department of Health and Human Services reported a 31% rise in healthcare data breaches linked to third-party discount platforms in Q2 2024.

The lack of federal oversight has led to differences in discount plan quality. However, 2024 marked a turning point. After a Federal Trade Commission crackdown on deceptive marketing by 12 providers, 28 states passed laws. These laws require clear fee structures and clinical outcome disclosures. The National Association of Insurance Commissioners proposed a new accreditation framework. This framework aims to separate clinically vetted plans from basic coupon schemes. Meanwhile, the IRS expanded eligibility for discount memberships as Qualified Medical Expenses under HSAs. This change has made these memberships a part of financial planning. As a result, the market is compressing. Smaller players without strong provider networks are facing consolidation.

At the same time, companies like UnitedHealthcare’s Surest branch are investing in compliance. The market is evolving and rethinking healthcare accessibility. Amid inflation, discount plans have moved from niche products to key parts of coverage strategies. A 2024 JAMA study found that 29% of ACA marketplace enrollees now use discount memberships to reduce underinsurance risks. Employers are also using these plans. About 41% of mid-sized companies offer them as voluntary benefits to attract talent without raising premiums.

In terms of geography, Sun Belt states like Texas and Florida lead with high uninsured rates and aging populations, driving 37% of national growth. However, sustainability challenges remain. Narrow profit margins push providers to focus on high-volume specialty networks, like dermatology and compounded drugs, instead of primary care partnerships. Looking ahead, collaborations with retailers, like CVS’s HealthHubs with discount kiosks, and fintechs, like HSA-linked payment tools, will likely shape the next phase of value creation.

United States Healthcare Discount Plan Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Service:

- Health Advocate

- Virtual Visits

- Alternative Medicines

- Prescription Drugs

- Dental Care

- Vision Care

- Hearing Aids

- Chiropractic Care

- Nurse Services

- Vitamins and Supplements

- Wellness Plans

- Podiatry Plans

- Others

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145