This staggering growth highlights the accelerating shift toward decentralized solutions in finance, supply chain, healthcare, and other sectors.

Free Sample Copy: https://www.stellarmr.com/report/req_sample/Blockchain-as-a-Service-Market/283

- Market Estimation Definition

Blockchain-as-a-Service (BaaS) refers to third-party cloud-based infrastructure and services that enable businesses to build, host, and manage blockchain applications and smart contracts. Much like Software-as-a-Service (SaaS), BaaS platforms allow enterprises to leverage blockchain capabilities without managing the complexities of infrastructure development or maintenance.

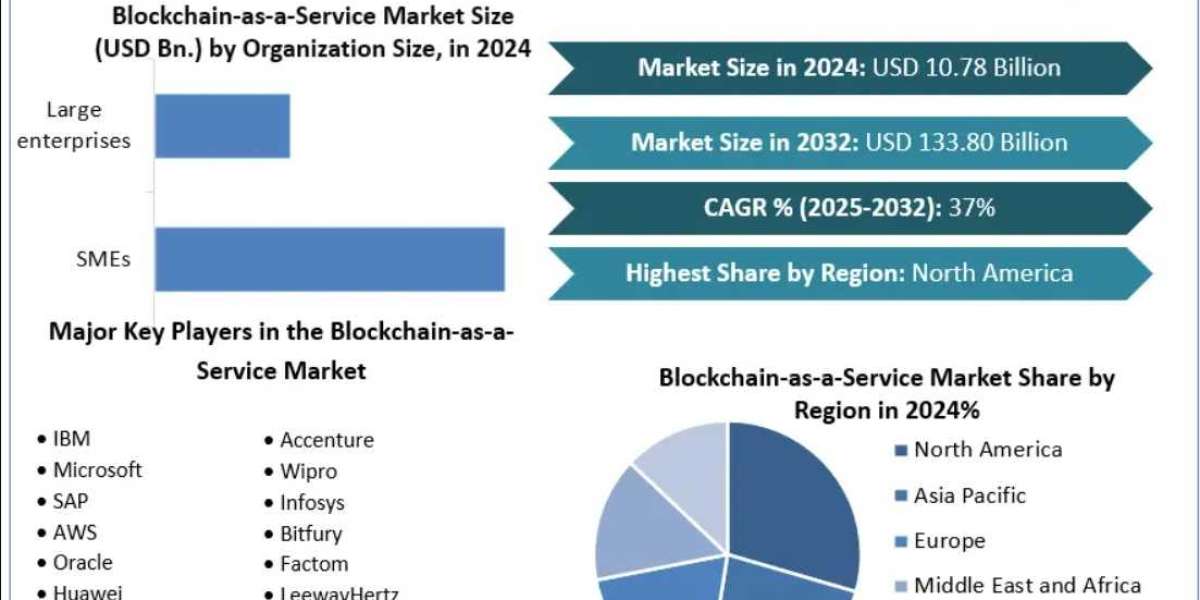

The market, valued at USD 2.57 billion in 2023, is expected to hit USD 103.55 billion by 2032, reflecting the rapid adoption of secure, scalable, and cost-effective blockchain solutions across industries.

Free Sample Copy: https://www.stellarmr.com/report/Blockchain-as-a-Service-Market/283

- Market Growth Drivers Opportunities

Rising Demand for Secure Data Transactions

Blockchain's core strengths—immutability, transparency, and decentralization—make it a natural fit for sectors like banking, logistics, and healthcare where secure and tamper-proof data sharing is critical. BaaS simplifies access to these benefits, enabling secure transaction ecosystems.

Surge in Cloud Adoption and Digital Transformation

With the global digital transformation wave, cloud infrastructure has become central to IT strategies. BaaS leverages cloud scalability, enabling enterprises to develop and deploy blockchain-based solutions with minimal investment in hardware or specialized skills.

Increased Use of Smart Contracts

Smart contracts—self-executing code on the blockchain—are transforming business logic and automation. Industries are increasingly adopting BaaS for streamlining transactions, reducing legal costs, and eliminating manual errors.

Demand from SMEs and Startups

Small and medium-sized enterprises, once hindered by high costs and infrastructure challenges, are now adopting BaaS platforms to drive innovation in areas such as identity verification, asset tracking, and cross-border payments.

Government and Regulatory Support

Governments in the U.S., Germany, and other developed economies are actively exploring blockchain frameworks for public administration, data governance, and tax compliance, bolstering demand for BaaS.

- Segmentation Analysis (Based on Report Insights)

According to Stellar Market Research, the BaaS market is segmented by component, organization size, application, industry vertical, and region.

By Component:

- Tools

- Services

The tools segment leads the market due to the rising need for development environments, APIs, and SDKs that simplify the deployment of blockchain networks. However, services are growing rapidly as consulting, deployment, and maintenance become integral to enterprise blockchain strategies.

By Organization Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

While large enterprises dominate the market in terms of investment and adoption, SMEs are emerging as high-growth adopters due to the scalable and cost-efficient nature of BaaS.

By Application:

- Supply Chain Management

- Smart Contracts

- Identity Management

- Payments

- Governance, Risk, and Compliance Management

- Others

Supply chain management is currently the most prominent application, with BaaS ensuring real-time product tracking, origin verification, and fraud prevention. Payments and identity management are also gaining traction amid rising concerns over fraud and data privacy.

By Industry Vertical:

- BFSI

- Healthcare

- Retail E-Commerce

- Manufacturing

- Government

- Energy Utilities

- Others

The BFSI sector continues to lead BaaS adoption, leveraging blockchain to secure transactions, streamline KYC/AML processes, and improve transparency. Healthcare and government are also key sectors due to the need for verifiable records and secure data sharing.

- Country-Level Analysis

United States

The U.S. holds a commanding position in the global BaaS market, thanks to its tech-forward enterprise culture, robust cloud ecosystem, and strong presence of BaaS providers like Microsoft, IBM, and Amazon Web Services. Startups and financial institutions in the U.S. are pioneering blockchain use cases from decentralized finance (DeFi) to supply chain traceability.

Regulatory bodies such as the SEC and the Federal Reserve are increasingly engaging with blockchain frameworks, offering clarity and fostering innovation in enterprise blockchain deployment. Government-funded blockchain initiatives are further catalyzing adoption.

Germany

Germany is one of Europe’s blockchain hubs, driven by initiatives such as the German Blockchain Strategy and its emphasis on data sovereignty, digital identity, and smart mobility. German industries, especially automotive, logistics, and manufacturing, are leveraging BaaS to increase supply chain transparency and efficiency.

Furthermore, German banks and financial regulators are exploring blockchain for clearing and settlement processes. Public-private partnerships and innovation centers like Blockchain Bundesverband are strengthening Germany’s leadership in European blockchain development.

- Competitor Analysis

The Blockchain-as-a-Service market is competitive and rapidly evolving, with a mix of tech giants, specialized vendors, and new entrants offering BaaS solutions.

Key Players:

- Microsoft Corporation – Azure Blockchain Service provides a fully managed ledger for consortium blockchain networks.

- IBM Corporation – Offers enterprise-grade BaaS on IBM Cloud powered by Hyperledger Fabric.

- Amazon Web Services (AWS) – AWS Managed Blockchain supports Ethereum and Hyperledger frameworks.

- Oracle Corporation – Offers scalable and secure BaaS services with integration into Oracle Cloud.

- Huawei Technologies Co., Ltd. – Delivers BaaS through its Blockchain Service Platform on Huawei Cloud.

- SAP SE – Integrates BaaS with its ERP and cloud solutions to offer supply chain and business process blockchain use cases.

- R3 – Offers blockchain software such as Corda tailored for regulated industries.

These players are focusing on partnerships, product innovation, and ecosystem development to expand their footprint and create interoperable BaaS platforms. Strategic collaborations with cloud providers and blockchain startups are common to enhance service offerings.

- Conclusion

The Blockchain-as-a-Service (BaaS) market is witnessing explosive growth, redefining how businesses interact, transact, and build trust across value chains. With the global market expected to surpass USD 103.55 billion by 2032, BaaS is no longer just a tech trend—it is becoming the infrastructure for the next digital revolution.

As enterprises across the U.S., Germany, and beyond accelerate digital transformation, BaaS is poised to become essential for enhancing transparency, reducing costs, and driving automation in a trustless world. With major players like Microsoft, IBM, and AWS setting benchmarks, the competitive landscape is rich with innovation and opportunity.

The journey ahead for Blockchain-as-a-Service is not just about adoption—it’s about building the backbone for secure, decentralized, and interoperable digital economies.

About Us

Stellar Market Research is a leading India-based consulting firm delivering strategic insights and data-driven solutions. With 119 analysts across 25+ industries, the company supports global clients in achieving growth through tailored research, high data accuracy, and deep market intelligence, serving Fortune 500 companies and maintaining strict client confidentiality.

Address

Phase 3, Navale IT Zone, S.No. 51/2A/2, Office No. 202, 2nd floor, Near, Navale Brg, Narhe, Pune, Maharashtra 411041

sales@stellarmr.com

Mobile

+91 9607365656