"Treasury Software Market Size And Forecast by 2030

The global Treasury Software Market study offers a thorough examination of the industry, highlighting the influence of leading companies on market dynamics and growth. These key players set the benchmark for innovation and operational excellence, contributing significantly to the development of the market. The study delves into their strategic initiatives, offering insights into how they navigate challenges and capitalize on opportunities. By focusing on these companies, the report paints a vivid picture of the competitive environment and its evolution.

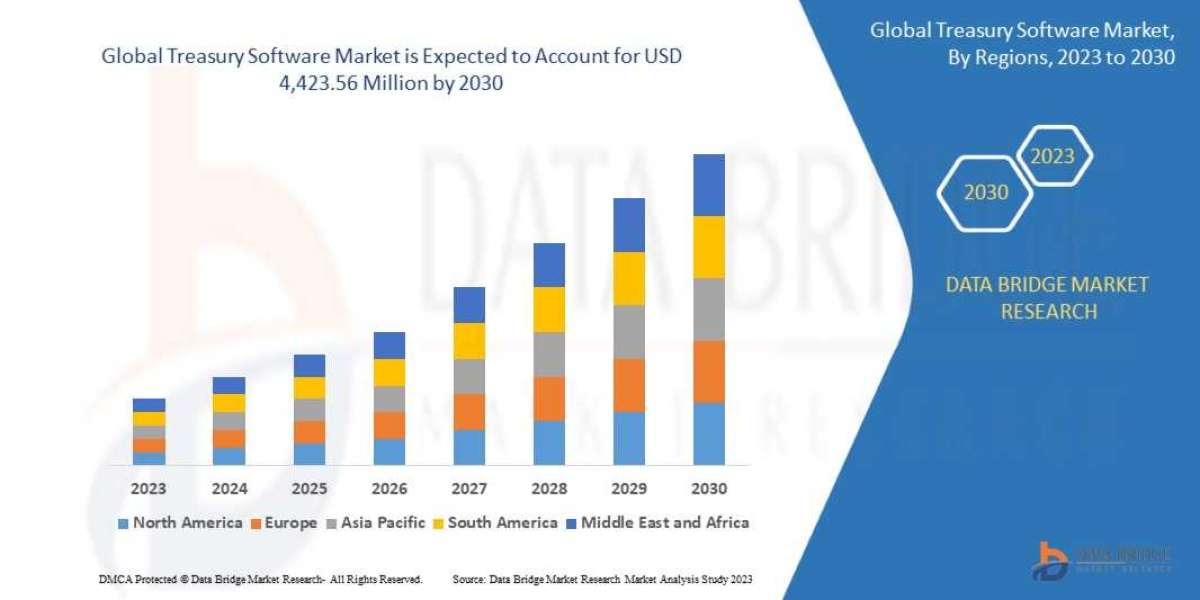

The global treasury software market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.1% from 2023 to 2030 and is expected to reach USD 4,423.56 million by 2030.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-treasury-software-market

Nucleus is a secure, cloud-based platform designed to streamline data transfer and management for businesses. Its intuitive interface offers practice administrators and financial managers advanced filtering options, enhancing operational efficiency. By integrating various data sources, Nucleus enables effective prioritization of critical exposures, incorporating business context and threat intelligence to bolster security measures. Additionally, Nucleus supports seamless collaboration among multiple users across different applications, fostering rapid iteration and teamwork. Its deployment flexibility allows installation on-premises or via preferred cloud service providers, ensuring scalability and adaptability to meet diverse organizational needs.

Get More Detail: https://www.databridgemarketresearch.com/nucleus/global-treasury-software-market

Which are the top companies operating in the Treasury Software Market?

The Top 10 Companies in Treasury Software Market are known for their strong presence and innovative solutions. These include industry leaders. Each of these companies has made significant contributions through cutting-edge products, strategic partnerships, and global reach. Their ability to adapt to market trends and consumer demands has helped them maintain leadership positions in the market, driving growth and setting industry standards.

**Segments**

- On-Premises

- Cloud-Based

The global treasury software market can be segmented into two main categories: On-Premises and Cloud-Based solutions. On-Premises software requires the organization to host the software on its own servers, providing them with complete control over their data and security. On the other hand, Cloud-Based solutions offer the flexibility of accessing the software from anywhere with an internet connection, reducing maintenance costs and providing scalability to businesses of all sizes.

**Market Players**

- Oracle Corporation

- Reval

- GTreasury

- FIS

- Kyriba

- Finastra

- Calypso Technology Inc.

- IBSFINtech India Pvt Ltd

- Indus Valley Partners

- Salmon Software Limited

Key players in the global treasury software market include industry giants such as Oracle Corporation, offering a wide range of treasury solutions for businesses of all sizes. Reval and GTreasury are also prominent players in the market, providing comprehensive treasury management systems tailored to meet the evolving needs of modern businesses. FIS, Kyriba, and Finastra are other major players that offer innovative software solutions to optimize treasury operations. Additionally, companies like Calypso Technology Inc., IBSFINtech India Pvt Ltd, Indus Valley Partners, and Salmon Software Limited contribute to the market with their specialized treasury software offerings.

https://www.databridgemarketresearch.com/reports/global-treasury-software-marketThe global treasury software market continues to witness significant growth driven by the increasing focus on digitization and automation of financial processes across industries. Treasury software plays a crucial role in helping organizations efficiently manage their cash flows, liquidity, risk, and investments, enhancing overall financial performance and decision-making capabilities. As businesses seek to streamline their treasury operations and enhance visibility and control over their financial assets, the demand for advanced software solutions is expected to rise.

One of the key trends shaping the treasury software market is the increasing adoption of cloud-based solutions. Cloud technology offers several advantages, including cost-effectiveness, scalability, and accessibility, making it an attractive option for organizations looking to modernize their treasury function. Cloud-based treasury software allows users to access real-time data and analytics from anywhere, improving decision-making processes and overall operational efficiency.

Another important trend in the market is the integration of artificial intelligence (AI) and machine learning (ML) capabilities into treasury software solutions. These advanced technologies enable automation of routine tasks, predictive analytics, and risk management, empowering treasury teams to focus on strategic initiatives and value-added activities. AI-driven treasury software can provide valuable insights into cash forecasting, financial risk management, and investment strategies, helping organizations optimize their treasury operations and drive business growth.

Moreover, the increasing regulatory compliance requirements and the growing complexity of financial transactions are fueling the demand for sophisticated treasury software solutions. Modern treasury systems offer advanced security features, compliance monitoring tools, and customizable reporting functionalities to help organizations meet regulatory mandates and mitigate risks effectively. With the rise of digital payments, cryptocurrencies, and blockchain technology, treasury software providers are also incorporating innovative features to support emerging trends and technologies shaping the future of finance.

Furthermore, the competitive landscape of the global treasury software market is characterized by the presence of several key players offering a diverse range of solutions tailored to meet the unique needs of various industries and businesses. Market leaders such as Oracle Corporation, Reval, GTreasury, FIS, and Kyriba continue to invest in research and development to enhance**Market Players**

- Finastra

- ZenTreasury Ltd

- Emphasys Software

- SSC Technologies, Inc.

- CAPIX

- Adenza

- Coupa Software Inc.

- DataLog Finance

- FIS

- Access Systems (UK) Limited

- Treasury Software Corp.

- MUREX S.A.S

- EdgeVerve Systems Limited (A wholly owned subsidiary of Infosys)

- Financial Sciences Corp.

- Broadridge Financial Solutions, Inc.

- CashAnalytics

- Oracle

- Fiserv, Inc

- ION

- SAP

- Solomon Software

- ABM CLOUD

The global treasury software market is witnessing growth driven by the increasing adoption of digital solutions and the automation of financial processes. With the focus on enhancing cash flow management, liquidity, risk analysis, and investment decisions, organizations across industries are turning to advanced software solutions. The market is characterized by key trends such as the rising popularity of cloud-based systems, providing cost-effectiveness and accessibility for businesses seeking modernization. Additionally, the integration of artificial intelligence and machine learning capabilities is transforming treasury operations by enabling automation, predictive analytics, and risk management, freeing up resources for strategic initiatives. The market is also responding to the demands of regulatory compliance by offering sophisticated security features, monitoring tools, and reporting functionalities to meet regulatory requirements effectively. As digital payments, cryptocurrencies, and blockchain technologies reshape the financial landscape, treasury software providers are innovating to support emerging trends and technologies

Explore Further Details about This Research Treasury Software Market Report https://www.databridgemarketresearch.com/reports/global-treasury-software-market

Key Insights from the Global Treasury Software Market :

- Comprehensive Market Overview: The Treasury Software Market is growing rapidly, driven by technological advancements and evolving consumer preferences.

- Industry Trends and Projections: The market is expected to grow at a CAGR of X% over the next five years, with increasing automation and digitalization.

- Emerging Opportunities: New market segments, such as sustainable and eco-friendly solutions, are creating significant growth prospects.

- Focus on RD: Companies are investing heavily in RD to innovate and improve product offerings, ensuring market leadership.

- Leading Player Profiles: Major player dominate the market with strong portfolios and strategic partnerships.

- Market Composition: The market is diverse, with a mix of large enterprises and emerging startups driving competition and innovation.

- Revenue Growth: The market has witnessed a steady increase in revenue, primarily driven by growing demand and product diversification.

- Commercial Opportunities: There are considerable opportunities for business expansion in emerging regions and through technological innovations.

Get More Reports:

Dried Spot Collection Cards Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2032

Cochlear Implants Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2032

Collapsible Tube Packaging Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2028

Dispensing Pharmacy Packaging Machine Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2029

Asia-Pacific Low Emissivity (Low-E) Glass Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2031

Precipitated Barium Sulfate Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2028

Cloud Infrastructure Services Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2030

Asia-Pacific Pancreatic Cancer Diagnostics Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2030

Demyelinating Diseases Therapeutics Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2029

Automated Insulin Delivery Devices Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2032

Plastic Corrugated Packaging Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2028

Middle East and Africa Digital Diabetes Management Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2028

Data Bridge Market Research:

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975