The global Digital Lending Platform Market research study takes into account a number of aspects that have a significant impact on business growth, including historical data, current market trends, the environment, technological innovation, forthcoming technologies, and industry technical progress. All of the data and information in the research comes from extremely reliable sources, including company websites, annual reports, white papers, journals, newspapers, and mergers. The thorough market report also includes information on the current condition of the industry, which can be used by firms and investors interested in this market for guidance and direction.

Download Sample Copy of this Report: https://www.snsinsider.com/sample-request/1785

Digital Lending Platform Market Key Players:

- Black knight, Inc.

- Ellie Mae, Inc.

- Finastra

- Fis

- Fiserv, Inc.

- Intellect design arena ltd

- Nucleus software exports ltd

- Tavant

- Temenos

- Wipro Limited

- Other Players

The Digital Lending Platform Market is rapidly evolving, driven by the increasing demand for efficient, accessible, and customer-centric financial services. These platforms leverage advanced technologies, such as artificial intelligence and machine learning, to streamline the lending process, from application to disbursement, significantly reducing the time and effort required for both lenders and borrowers.

Market Segmentation

The Digital Lending Platform Market is divided into four categories: product type, end user, application, and geography. The growth of these sectors will aid you in analyzing inadequate growth segments in the industries, as well as providing users with a comprehensive market overview and industry insights to aid them in making strategic decisions for core market application identification.

On The Basis of Solution

- Business Process Management

- Lending Analytics

- Loan Management

- Loan Origination

- Risk Compliance Management

- Others

On The Basis of Service

- Design and Implementation

- Training and Education

- Risk Assessment

- Consulting

- Support and Maintenance

On The Basis of Deployment Mode

- Cloud

- On-premises

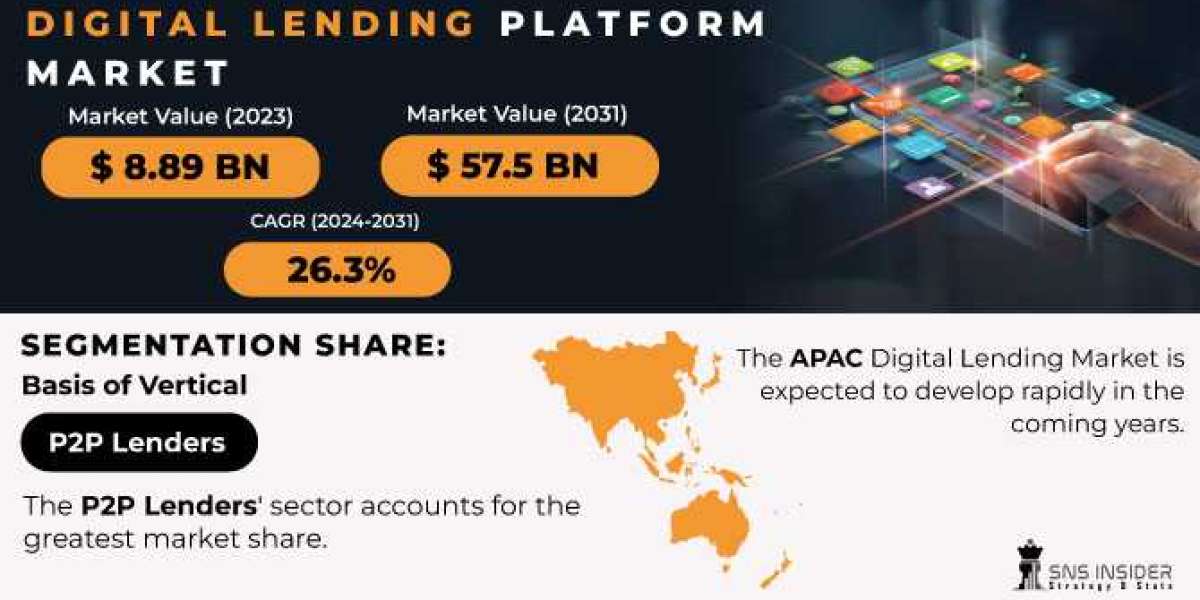

On The Basis of Vertical

- Banking

- Financial Services

- Insurance

- Credit Unions

- Retail Banking

- P2P Lenders

Browse Complete Report: https://www.snsinsider.com/reports/digital-lending-platform-market-1785

Regional Analysis

The study includes the United States, Canada, China, India, Japan, South Korea, the United Kingdom, Germany, France, Brazil, and Mexico at the global, regional, and country levels. Market estimates and predictions for the study's segmentation will be offered at the regional and country levels. The market estimates and predictions will help you understand the leading region in the Digital Lending Platform Market business as well as the next region that will generate substantial revenue.

Competitive Outlook

A chapter of the market analysis is devoted to important players in the Digital Lending Platform Market, including a review of the company's business, financial statements, product overview, and strategic aspirations. The organizations covered in the report can be customized to meet the needs of a client. The competitive analysis sections will assist participants in acquiring a thorough picture of the competition in the market.

Major Reasons to Purchase Digital Lending Platform Market Report

Outgrowth market trends in business as an entry-level grasp of business are global essential factors. Outlook discoveries vital key items, company recommendations that are in-depth by growth, long-term with identifying strategies Develop/modify progressive and as their firm grows and develops in order to realign markets. Highlights trends that are driving research, permitting fragmentation and, as a result, impeding industry process verticals.