In today’s fast-paced and competitive business environment, managing operational costs is more critical than ever—especially for small and medium-sized enterprises (SMEs). One of the most effective strategies to reduce these expenses is by outsourcing bookkeeping services in the UK along with professional payroll services. Not only does this improve financial accuracy, but it also enhances compliance, efficiency, and decision-making.

Why Operational Costs Are Rising

Many businesses in the UK are facing increasing operational costs due to inflation, regulatory changes, rising labour costs, and administrative overhead. Traditional in-house financial management methods can be time-consuming and expensive, especially when errors lead to penalties or compliance issues.

This is where expert bookkeeping and payroll services come into play.

The True Value of Bookkeeping Services in UK

Hiring a professional for bookkeeping services in the UK ensures your financial data is accurately recorded, up to date, and legally compliant. Whether you’re a startup, a freelancer, or an established business, proper bookkeeping lays the foundation for sustainable growth.

Benefits of Outsourced Bookkeeping:

- Cost Reduction: Save on hiring, training, and maintaining an in-house accounting team.

- Accuracy Compliance: Avoid costly errors and stay compliant with HMRC regulations.

- Time Efficiency: Focus on growing your business while experts handle the numbers.

- Real-Time Reporting: Access up-to-date financial reports for better decision-making.

When you have access to clean and organized financial data, forecasting becomes easier, cash flow can be managed more efficiently, and financial planning becomes more strategic.

Payroll Services: More Than Just Paying Employees

Payroll is often underestimated, but it’s a crucial function of any business. Outsourcing payroll services in the UK ensures timely and accurate salary payments, tax submissions, pension contributions, and compliance with employment laws.

Key Advantages:

- Avoid Penalties: Mistakes in payroll processing can lead to heavy fines from HMRC.

- Employee Satisfaction: Timely and correct payments build trust and morale.

- Regulation Ready: Experts stay updated with the latest payroll laws and tax codes.

- Secure Data Handling: Professional services often use encrypted, secure platforms for handling sensitive employee data.

When combined with bookkeeping, payroll services create a seamless financial workflow that saves both money and time.

How It All Helps Reduce Operational Costs

Here’s how integrating bookkeeping services in UK and payroll support contributes to cost reduction:

- Eliminates Redundant Processes

With everything streamlined digitally, businesses reduce manual efforts and eliminate duplicated tasks, saving on resources. - Prevents Financial Penalties

Late tax filings, payroll errors, and missed deadlines can cost businesses thousands. With experts on board, these risks are minimized. - Reduces Overhead Expenses

Outsourcing reduces the need for full-time staff, office space, software licensing, and training costs. - Improves Financial Decision-Making

Clean and timely reports allow business owners to make smarter, data-driven decisions—leading to more effective budgeting and investment.

Choosing the Right Service Provider in the UK

When selecting a provider for bookkeeping services in UK, it’s essential to look for experience, transparency, and technology integration.

Key Features to Consider:

- Cloud-based accounting platforms like Xero or QuickBooks

- Experience with UK tax laws and industry-specific regulations

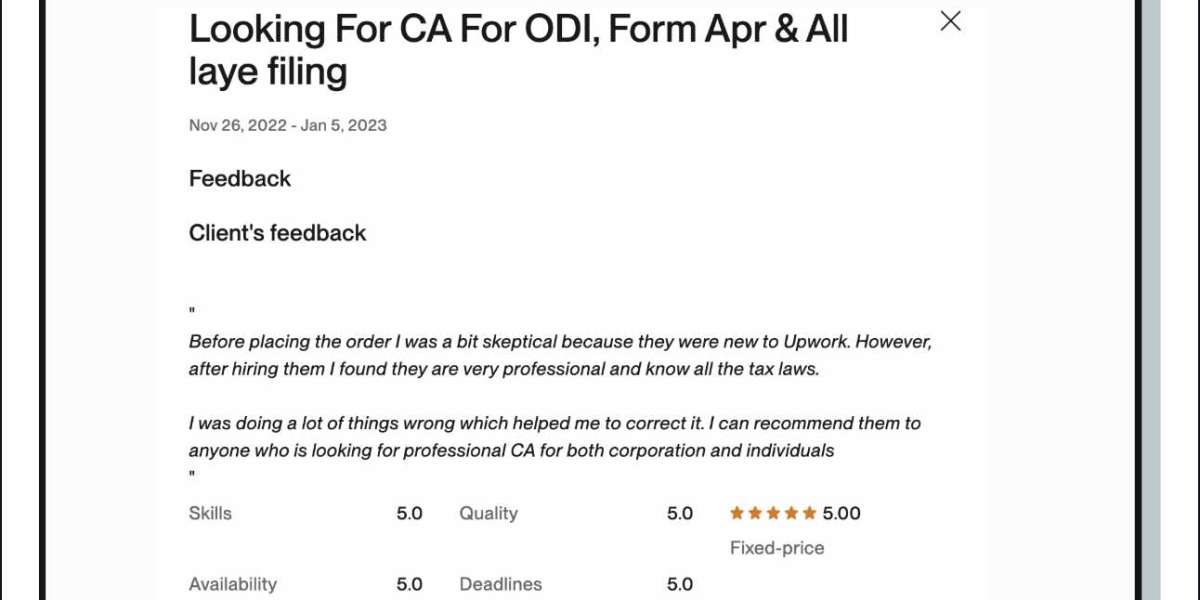

- Positive client reviews and testimonials

- Transparent pricing with no hidden fees

The right partner should act as an extension of your business—not just a service provider.

Small Businesses: The Biggest Gainers

If you’re a small business owner, you likely wear multiple hats. Delegating financial tasks to a trusted bookkeeping and payroll service frees you up to focus on sales, marketing, and growth strategies.

By outsourcing, small businesses in the UK often find they can:

- Scale faster

- Respond quicker to financial challenges

- Stay compliant without the stress

- Access expertise they couldn't afford to hire full-time

Final Thoughts

Reducing operational costs doesn’t always mean cutting corners—it often means working smarter. By partnering with trusted professionals for bookkeeping services in UK and expert payroll management, businesses can boost efficiency, reduce risk, and make more informed financial decisions.

Whether you're just starting out or looking to streamline your existing processes, now is the time to evaluate how outsourcing financial tasks can unlock greater value for your business.

Looking for affordable and reliable bookkeeping and payroll services in the UK? Get in touch with a certified provider today and start saving time, money, and stress.