The Philippines Luxury Goods Market Size has seen consistent growth in recent years, driven by factors such as an increasing affluent consumer base, a growing number of high-net-worth individuals, and a stronger focus on personal status and material possessions. The market for luxury goods, valued at approximately USD 6.10 billion in 2024, is projected to grow at a compound annual growth rate (CAGR) of 4.2% between 2025 and 2034, ultimately reaching almost USD 8.83 billion by 2034. The luxury goods market encompasses high-end items such as apparel, accessories, watches, jewelry, beauty products, automobiles, and high-tech gadgets.

Market Overview

The Philippines luxury goods market is a dynamic sector with significant potential for growth, primarily driven by an increase in disposable income, changing lifestyles, and evolving consumer preferences. As one of the most economically vibrant nations in Southeast Asia, the Philippines has seen a steady rise in consumer spending on luxury items, thanks to the growing aspirations of the country's middle and upper classes. Additionally, a significant portion of the luxury goods market is influenced by foreign tourists, particularly from China, Japan, South Korea, and the U.S., who seek premium products during their visits to the Philippines.

While luxury goods were traditionally limited to a niche demographic, today, the rise of social media and influencer culture has widened the audience. The younger generation, including millennials and Gen Z, are becoming an increasingly important consumer group for luxury brands. They are more inclined to purchase luxury items online, with e-commerce platforms providing easy access to global brands. The shift toward digital retailing has also been accelerated by the COVID-19 pandemic, which drove consumers to make more online purchases.

Key Benefits of the Luxury Goods Market in the Philippines

Economic Growth: The continued economic growth of the Philippines contributes to an increase in the purchasing power of the country’s middle and upper classes, expanding the potential market for luxury goods.

Rising Disposable Income: The expanding affluent class, especially the growing number of high-net-worth individuals (HNWIs), fuels demand for high-end goods such as jewelry, fashion, and automobiles.

Changing Consumer Preferences: A shift toward a more status-conscious and aspirational consumer base, particularly among millennials and younger generations, increases demand for luxury products.

Rising Influence of Social Media and E-Commerce: Digital platforms play an essential role in shaping purchasing behavior, with online shopping offering consumers easy access to international luxury brands and exclusive collections.

Tourism-Driven Demand: The Philippines remains a top destination for foreign tourists, who contribute significantly to the demand for luxury goods, especially in metropolitan areas like Metro Manila.

Market Segmentation

The Philippines luxury goods market can be segmented by product type, distribution channel, and consumer demographics.

By Product Type:

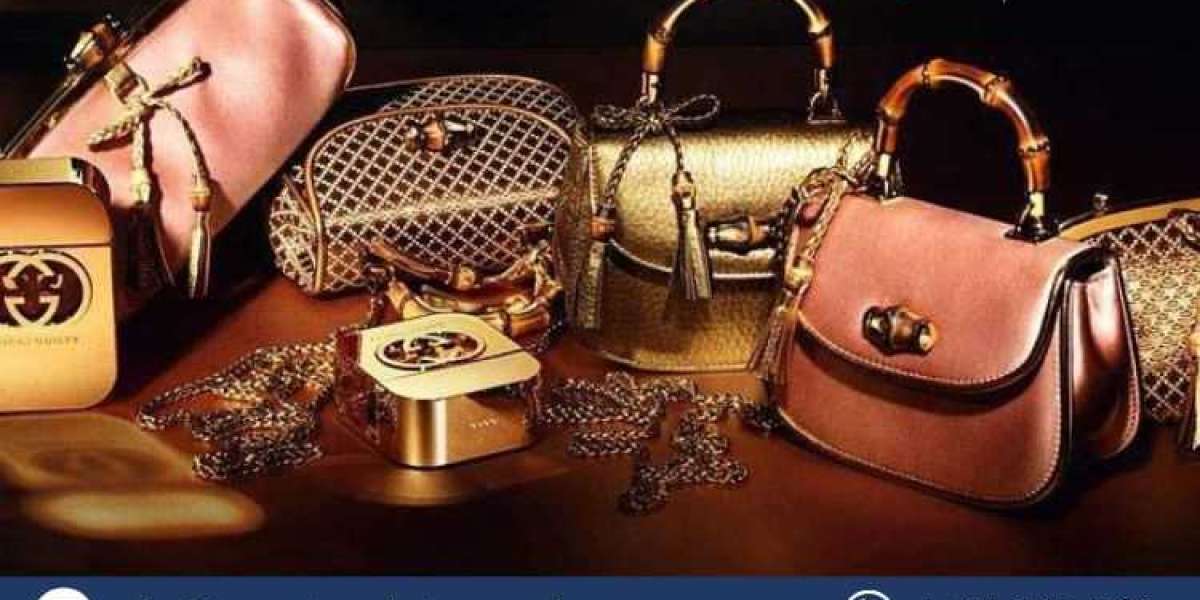

- Luxury Apparel and Accessories: This category includes designer clothing, handbags, shoes, and accessories from renowned brands such as Louis Vuitton, Gucci, and Chanel.

- Luxury Jewelry and Watches: High-end jewelry, watches, and diamonds from prestigious names like Rolex, Cartier, and Bulgari.

- Luxury Automobiles: This includes vehicles from premium brands such as Mercedes-Benz, BMW, and Porsche.

- Luxury Beauty Products: High-end skincare, perfumes, cosmetics, and hair care products from brands like Estée Lauder, Dior, and Chanel.

- Luxury Technology and Gadgets: This category includes premium smartphones, smartwatches, and electronics from Apple, Samsung, and other high-end tech brands.

By Distribution Channel:

- Offline Retail: Traditional brick-and-mortar retail outlets, luxury department stores, and exclusive brand boutiques remain a popular shopping destination for luxury consumers.

- Online Retail: E-commerce platforms such as Lazada, Shopee, and global websites of luxury brands offer convenience and accessibility, catering to the growing trend of online shopping.

- Personal Shoppers and Concierge Services: Personalized luxury shopping experiences continue to be in demand, particularly among high-net-worth individuals.

By Consumer Demographics:

- Affluent Consumers: The primary consumer base for luxury goods in the Philippines is affluent individuals with higher disposable incomes and aspirations for luxury products.

- Tourists: Foreign tourists, particularly from China, South Korea, and Japan, make a significant contribution to luxury goods sales, especially in popular tourist destinations like Metro Manila, Cebu, and Davao.

Trends in the Luxury Goods Market

The Philippines luxury goods market is evolving with the following trends:

Experience-Oriented Luxury: Consumers in the Philippines are increasingly looking for more than just physical products. There is a growing demand for luxury experiences such as exclusive events, travel packages, and bespoke services.

Sustainability and Ethical Consumption: With an increasing focus on sustainability, Filipino consumers are becoming more conscious of the ethical implications of their purchases. Luxury brands are responding by offering eco-friendly and sustainable products.

Digital Transformation: E-commerce and social media platforms play an ever-larger role in the luxury goods market. High-end brands are investing in online strategies, influencer collaborations, and virtual experiences to engage younger, tech-savvy consumers.

Customizable and Personalized Products: The trend toward personalized luxury goods is becoming more prevalent. Consumers are looking for unique products that reflect their individual tastes and personalities, prompting brands to offer more customization options.

Industry Segmentation and Regional Analysis

Industry Segmentation: The luxury goods industry in the Philippines is dominated by the fashion and accessories segment, followed closely by the automotive and beauty product segments. The growing influence of social media and celebrities has helped fuel demand in these segments.

Regional Insights:

- Metro Manila: The capital region, which includes Quezon City, Makati, and Taguig, is the epicenter of luxury consumption, with a large concentration of luxury boutiques, department stores, and luxury shopping malls such as Greenbelt and Rockwell Power Plant Mall.

- Cebu: Cebu is another significant luxury market, benefiting from tourism and the growing wealth of the local population.

- Davao: Davao has also emerged as a regional luxury hub, with increasing disposable income and a rising demand for premium products.

Key Industry Developments

Luxury Brands Entering the Philippine Market: Several global luxury brands have expanded their presence in the Philippines. These include high-end fashion and accessories brands such as Burberry, Prada, and Louis Vuitton, as well as automotive giants like Ferrari and Lamborghini.

Digital Transformation of Luxury Retail: The shift to online shopping is evident in the luxury market as many brands have begun enhancing their digital channels. Online platforms now provide access to exclusive products, with some brands offering virtual try-ons and consultations.

Exclusive Collaborations: Many luxury brands are partnering with influencers and celebrities to create limited-edition collections targeted at Filipino consumers. These collaborations have proven to be effective in generating buzz and exclusivity.

Key Driving Factors

Growing Affluent Population: An expanding affluent class and high-net-worth individuals (HNWIs) are the main drivers behind the growth of the luxury goods market.

Urbanization: The growing number of urban centers in the Philippines, particularly Metro Manila, has led to greater access to luxury goods and services.

Evolving Consumer Preferences: Younger generations are increasingly focused on status, and luxury goods are seen as symbols of social success.

COVID-19 Impact

The COVID-19 pandemic had a significant impact on the luxury goods market, particularly in 2020 and 2021, with store closures, travel restrictions, and economic uncertainties limiting consumer spending. However, as the pandemic has subsided and the economy has rebounded, demand for luxury goods has returned to pre-pandemic levels, bolstered by the growth of e-commerce and the desire for consumers to indulge themselves post-pandemic.

Major Key Players

- Chanel Limited

- Rolex SA

- Giorgio Armani S.p.A

- Estee Lauder Companies Inc.

- Ralph Lauren Corporation

- Cartier International AG

- Burberry Group plc

- Others

Opportunities

Expanding Digital Retail: The growing preference for online shopping presents an opportunity for luxury brands to enhance their e-commerce platforms and digital presence.

Personalized Luxury Experiences: Offering unique and customized luxury experiences could be a lucrative opportunity for high-end brands.

Sustainability: The increasing demand for ethically sourced and sustainable luxury goods presents an opportunity for brands to innovate and attract eco-conscious consumers.

Challenges

High Import Taxes: The luxury goods sector is challenged by high import duties and taxes, which can raise the retail price of luxury items.

Economic Inequality: The stark wealth divide in the Philippines can limit the consumer base for luxury goods, restricting growth to a small but affluent demographic.

Scope

The future scope of the Philippines luxury goods market is bright, with ongoing improvements in economic conditions, increasing urbanization, and a growing appetite for premium products among the younger generations. Additionally, the rise of online retailing, along with greater access to global luxury brands, provides a solid foundation for future growth.